- The Aussie remains on the softer side as bullish pushes get capped off quickly.

- Wednesday sees little Aussie-focused data, and AUD bulls will be looking for a good-looking jobs report on Thursday.

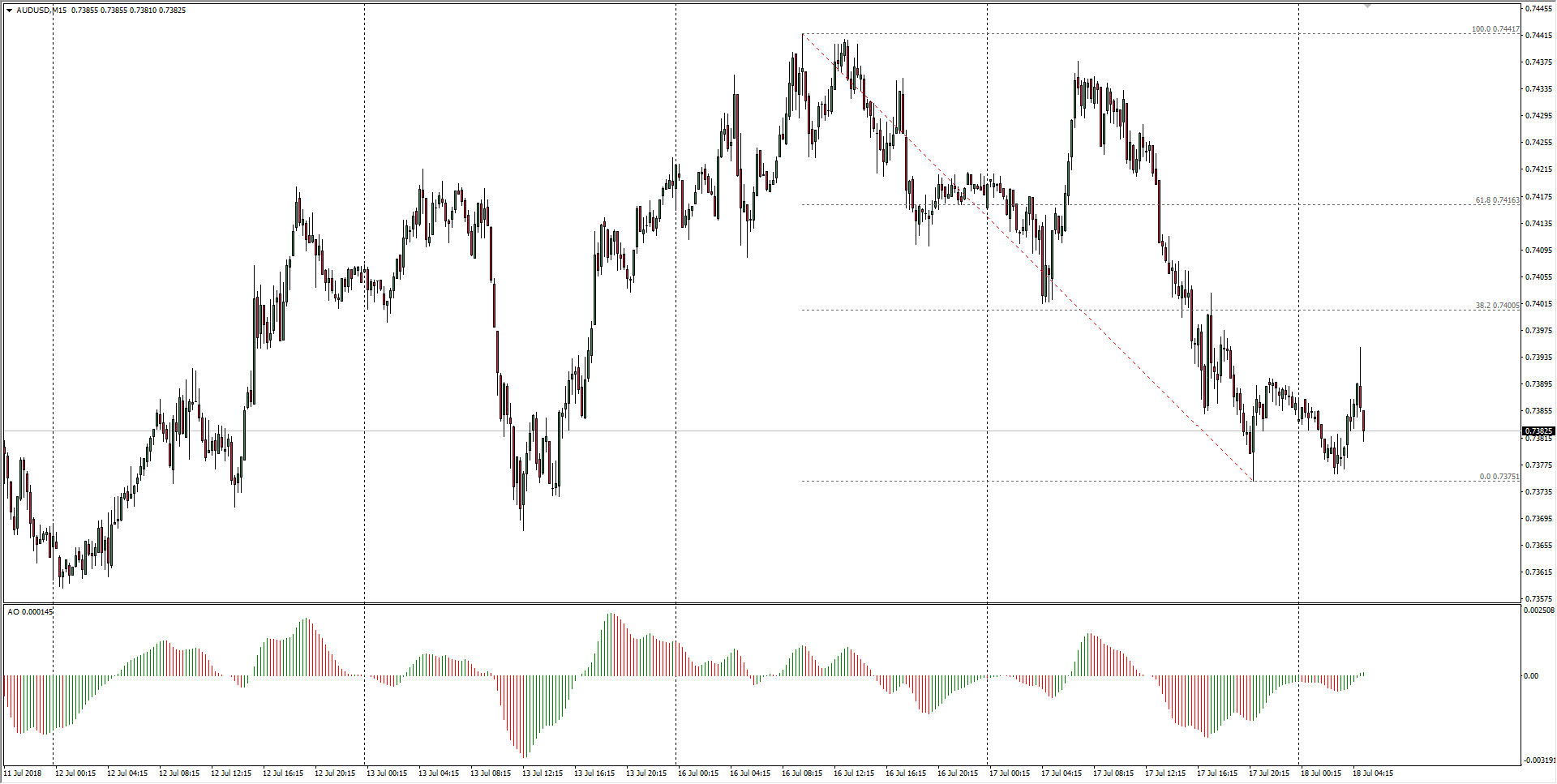

The AUD/USD is continuing to cycle close to Wednesday’s opening prices near 0.7385 after kicking lower to start off the overnight session, and peaking just beneath the 0.7400 key level. Market direction remains in the middle as traders shift in place with bearish pressures remaining in place.

Wednesday saw the Westpac Leading Indicator for June come in at 0.0%, an improvement over the previous reading of -0.2%, but the low-tier indicator saw little impact as traders turn their eyes to Thursday’s jobs report.

The Australian Unemployment Rate and Participation Rate will be dropping at 01:30 GMT on Thursday, alongside the Full-time and Part-time Employment metrics. The Unemployment and Participation Rates are expected to hold steady at 5.4% and 65.5% respectively, while the Employment Change is expected to clock in at 17 thousand versus the previous reading of 12 thousand.

AUD/USD Technical Analysis

The Aussie kicked higher during the early Asia trading session, but the USD remains stubbornly strong heading into Wednesday and is still pushing the AUD into defensive territory.

AUD/USD Chart, 15-Minute

| Spot rate: | 0.7383 |

| Relative change: | -0.05% |

| High: | 0.7395 |

| Low: | 0.7376 |

| Trend: | Bearish |

| Support 1: | 0.7375 (previous day low) |

| Support 2: | 0.7359 (previous week low) |

| Support 3: | 0.7309 (2018 low; major technical bottom) |

| Resistance 1: | 0.7400 (major technical level) |

| Resistance 2: | 0.7416 (61.8% Fibo retracement level) |

| Resistance 3: | 0.7441 (current week high) |