- Aussie’s employment-fueled bull run ended prematurely on Friday, and the AUD fell near yearly lows.

- Friday’s thin calendar will see AUD buyers challenging ongoing short flows.

The AUD/USD is trading into familiar territory near 0.7360 after dipping to a session low on Thursday of 0.7322.

Comments from US President Trump late in the day caused a spike in the pair, seeing a quick recovery to 0.7380 as the US Dollar weakened following Trump’s statement that he doesn’t like the pace of interest rate hikes. The USD weakened rapidly on the comments from the US POTUS, but markets are stabilizing and the AUD/USD is beginning to bed back down into bearish levels.

Friday is a thin showing for both the Aussie and the Greenback on the economic calendar, and it’s up to broader market sentiment to pick a direction moving into the week’s end, though Aussie bulls will be looking to jump-start early Friday’s bull run off the back of a stellar reading for the Australian employment figures yesterday, which showed Australia adding a forecast-crushing 50,900 jobs in June.

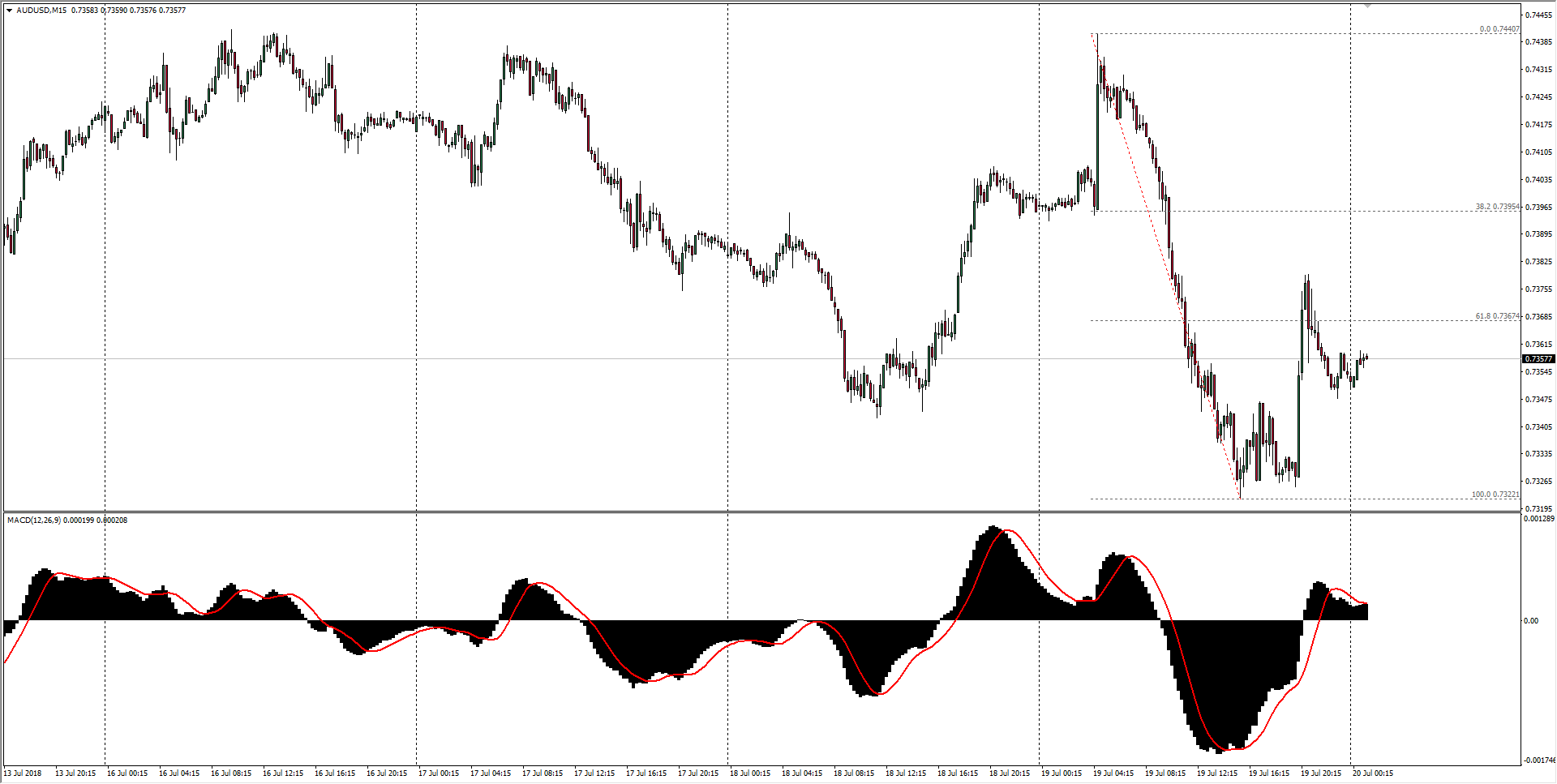

AUD/USD Technical Analysis

The Aussie-Dollar pairing is correcting back lower heading into Friday’s overnight session, and bearish pressure is expected to pick up beneath 0.7345; a renewed USD selloff, however, could see the pair back to challenge the 0.7400 critical handle. Bears will have to compete with Aussie buyers who are trying to ride the Aussie employment figures, while looking to capitalize on weakness in the pair fueled by Dollar-buying and take the 0.7330 level.

AUD/USD Chart, 15-Minute

| Spot rate | 0.7357 |

| Relative change: | 0.05% |

| High: | 0.7360 |

| Low: | 0.7350 |

| Trend: Bearish | |

| Support 1: | 0.7322 (previous day low) |

| Support 2: | 0.7310 (2018 low; major technical bottom) |

| Support 3: | 0.7290 (S3 daily pivot) |

| Resistance 1: | 0.7395 (61.8% Fibo retracement level) |

| Resistance 2: | 0.7440 (current week high) |

| Resistance 3: | 0.7483 (previous week high) |