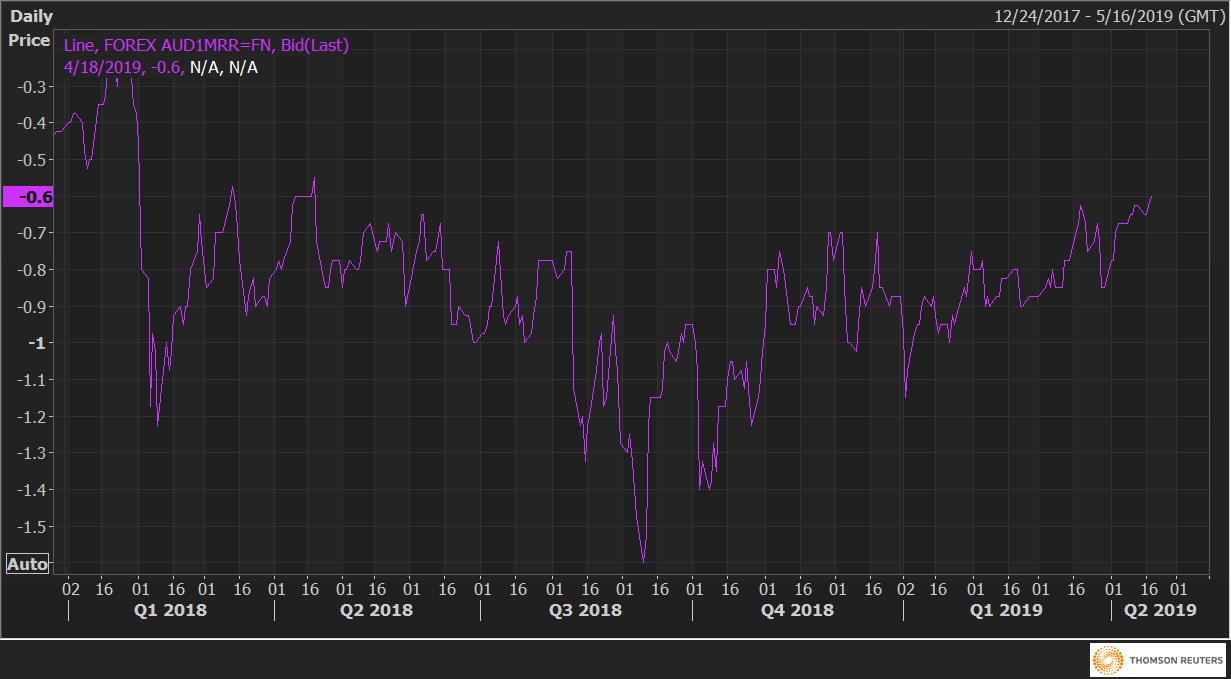

AUD/USD one-month 25 delta risk reversals (AUD1MRR), a gauge of puts to calls on the Australian currency, is currently trading at -0.60, the highest level since April 18, 2018, indicating fading demand for the AUD bearish bets (put options).

While the negative number indicates the premium pair for puts (demand) is still higher than that for calls.

The premium for puts, however, is at one-year lows and has dropped sharply in the last 20 days. This is evident from AUD1MRR’s rise from -0.9 (March 29 low) to the current level of -0.60.

The data indicates the AUD/USD could soon find acceptance above the 200-day moving average (MA), currently at 0.7194. The moving average has proved a tough nut to crack in the last 24 hours.

AUD1MRR