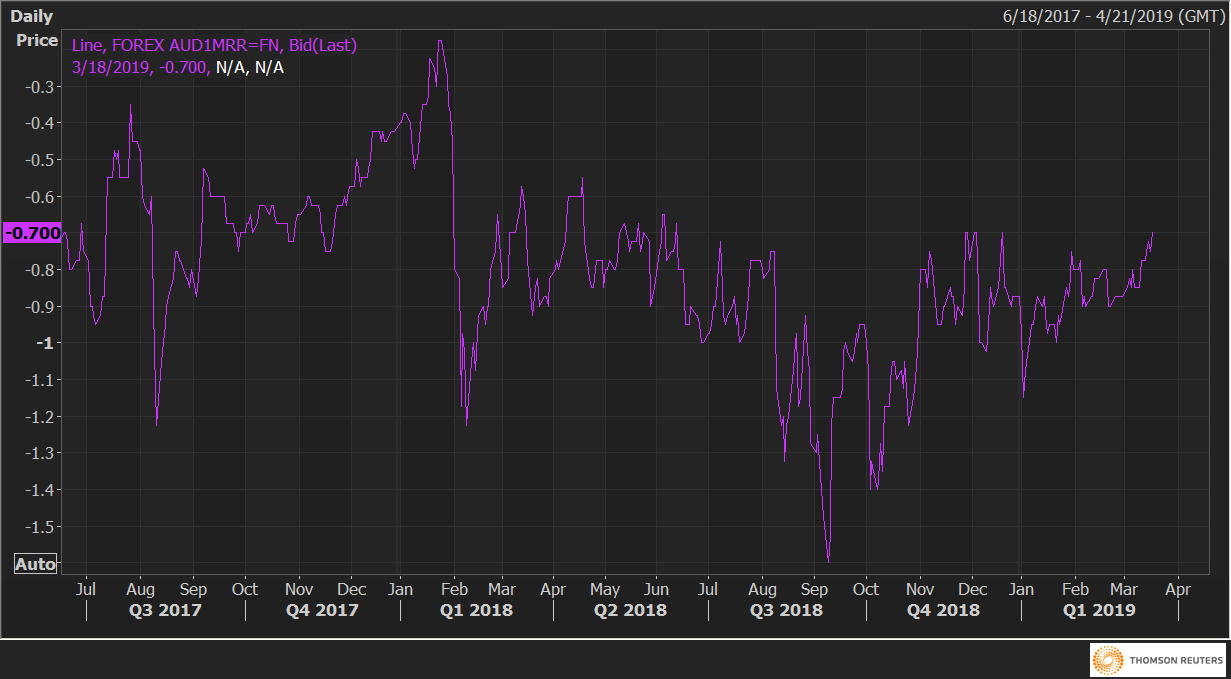

One-month 25 delta risk reversals on AUD/USD (AU1MRR), a gauge of calls to puts, is currently trading at -0.70 in favor of puts (bearish bets) – the highest level since Dec. 19.

While the negative number indicates the put options are still in demand, the bid has weakened in the last three weeks, as indicated by an improvement in risk reversals from -0.90 seen on Feb. 22. Also, the gauge has improved sharply from the low of -1.60 seen in the third quarter last year.

So, it seems safe to say that bearish AUD sentiment is weakening even though the Aussie money markets are pricing in two rate cuts in the next 12 months.

AU1MRR