- AUD/USD has been dropping as coronavirus spreads and amid a worsening market mood.

- The RBA decision, disease updates, and US jobless claims are eyed in the week leading to Easter.

- Early April’s daily chart is showing that bears are in control.

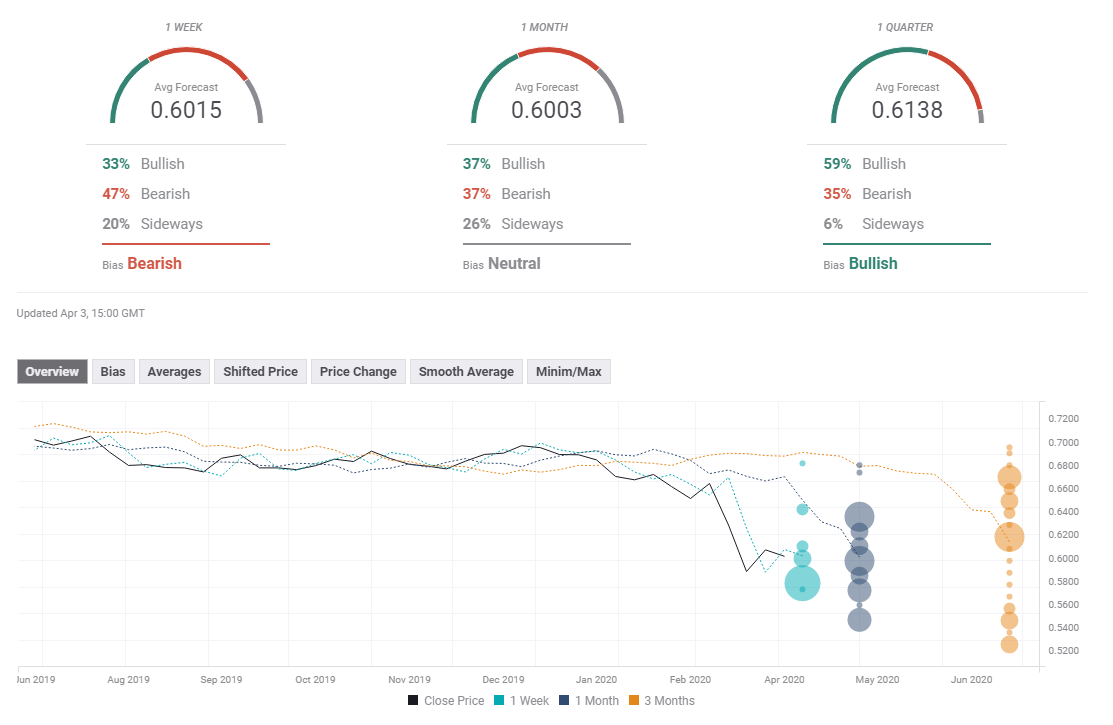

- The FX Poll is pointing to long-term gains.

The thrill is gone – AIUD/USD’s sugar rush, fueled by monetary and fiscal stimulus, faded out. As COVID-19 continues spreading around the world, the mood soured, and the risk-off sentiment is weighing on the Aussie. The first full week of April consists of updates from central banks and plenty of coronavirus headlines.

This week in AUD/USD: Risk-off takes its toll

More than one million people have been confirmed to have COVID-19, and over 50,000 have died. The rising human toll has weighed on sentiment and also implies a more serious economic damage. The Australian dollar – a risk currency – succumbed to the safe-haven US dollar.

President Donald Trump changed his tone and adopted a more somber approach – talking about two painful weeks and extending the social distancing guidelines to the end of April. Around a quarter of total coronavirus cases are in the US, with New York on the verge of having more infections than any country.

Most US states have imposed stay-at-home orders, and that has triggered mass layoffs. Weekly jobless claims for the week ending March 28 surged to 6.648 million – worse than the direst expectations. The Non-Farm Payrolls report showed a loss of 701,000 jobs, far worse than forecasts but not reflecting the real magnitude of the damage, as it was compiled in the middle of the month.

Other indicators – previously considered leading ones – seem stale amid the rapid pace of events. That applies to American and Australian figures alike. While the Australian Industry Group’s Construction Index tumbled to 37.9 points, the Manufacturing Index climbed to 53.7 in March – reflecting expansion.

The land down under has only around 5,000 confirmed cases at the time of writing, and fewer than 100 deaths. Perhaps that is why Prime Minister Scott Morrison said that “every job is essential” – a relatively upbeat approach as several countries called off work that cannot be performed at home.

China, Australia’s No. 1 trade partner, is attempting to return to normal. However, there are growing suspicions about the world’s second-largest economy’s coronavirus figures. US intelligence services reported that the number of mortalities is probably much higher than around 3,000 confirmed by Beijing. Recent economic data also seems too rosy. Purchasing Managers’ Indexes for March – official and independent statistics for both the manufacturing and services sectors – have all come out above expectations

Australian and Chinese events: Coronavirus data and Chinese PMIs

Updates on the disease remain left, right, and center. An increase in COVID-19 cases in Australia may weigh on the Aussie. If China returns to lockdowns, it would also be a disappointing sign. The Australian economy depends on commodity exports to China, and any new restrictions could hurt the economy.

The Reserve Bank of Australia’s rate decision stands out on the economic calendar. The Canberra-based institution has already slashed borrowing costs to 0.25% and kicked off Quantitative Easing on a limited scale. Governor Phillip Lowe and his colleagues may decide to wait for more developments before expanding the program, but the fast pace of events means anything is possible.

Australian Trade Balance and Home Loan figures are for February – before the crisis – and will likely be ignored. China’s inflation figures late in the week may show if disruptions to manufacturing – the supply shock – have pushed prices higher.

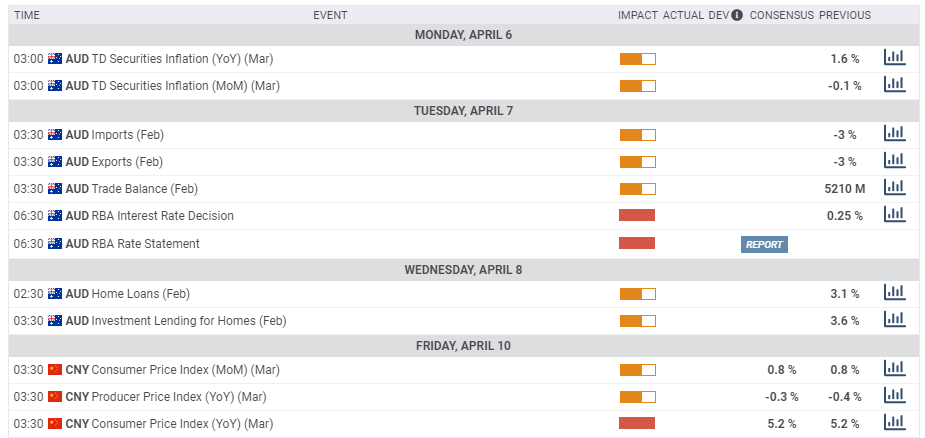

Here the most prominent Australian and Chinese releases on the economic calendar:

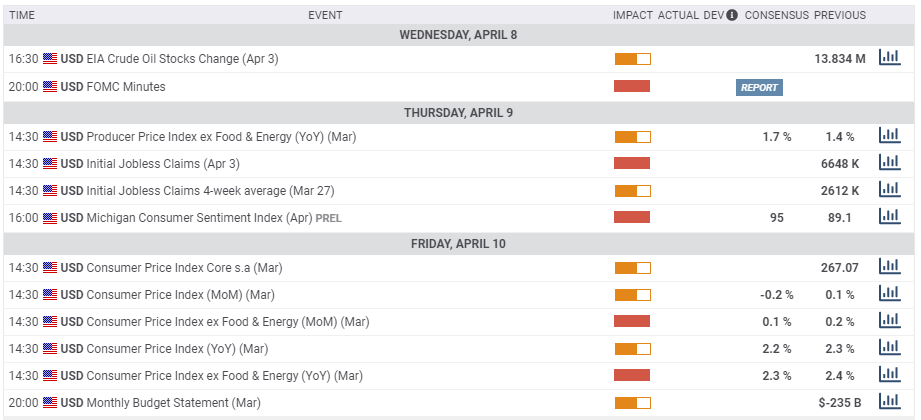

US events: Consumer confidence, claims, and coronavirus carnage

The US is likely to see significant increases in coronavirus cases, as testing is ramped up in the world’s largest economy. The greater fear is for a rapid rise in deaths, which may pass 10,000 in the coming days. The few holdout states are likely to impose “shelter in place” orders, and others may extend their lockdown. The pace of closures may impact market sentiment.

Lawmakers are already mulling another fiscal package as $2.2 trillion may be insufficient to tackle the magnitude of the shutdown. So far, the administration has been focused on implementing the current program rather than moving forward with additional expenditure. If another plan is pushed forward, it may improve the mood and drive the dollar down.

Jobless claims remain the most significant figure due to its freshness. The number of applications is unlikely to fall below five million and may even exceed ten million.

Additional highlights include the Federal Reserve’s meeting minutes from its recent emergency, unscheduled meetings. It will be interesting to see how worried policymakers were when confronting a potential financial crisis in addition to the health and economic ones. Moreover, the document may shed light on the Fed’s next moves.

The University of Michigan’s preliminary Consumer Sentiment Index for April will likely show a plunge in confidence- as the public understands the scale of the problem and soaring unemployment.

Inflation figures for March are due out on Good Friday, but will probably be shrugged off by markets which are now focused on unemployment.

Here are the top US events as they appear on the forex calendar:

AUD/USD Technical Analysis

Bears are in control as AUD/USD trades below the 50, 100, and 200-day Simple Moving Averages, and momentum remains to the downside. Moreover, the Relative Strength Index is above 30 – outside oversold conditions.

The psychologically significant 0.60 level is of high importance and remains a critical battle line. The round 0.61 marks provided some support in late March. It is followed by the recent peak of 0.6210, and then by 0.6305.

Support awaits at 0.5870, a swing low in late March. The next significant cushion is only at 0.5660, a low point in mid-March. The multi-year trough of 0.5505 is the last line to watch.

AUD/USD Sentiment

There is still no light at the end of the tunnel, and it will probably get worse before it gets better. These cliches are relevant to coronavirus, and the entailing risk-off atmosphere points to another downfall.

The FX Poll is showing that experts foresee limited movements in the short and medium terms, with a bullish move afterward. The average targets have been downgraded on all timeframes, but do not include substantial falls from current levels.

Related Reads

- EUR/USD Forecast: Back in the bearish path amid blindfold dollar’s demand

- GBP/USD Forecast: Death cross pattern, rising cases, and evidence of economic damage all point down

- Explained: What indicators matter in coronavirus times

-637215085937700403.png)