- AUD/USD shoots to fresh 0ne-month highs on US dollar weakness.

- Fed Chairman Powell has set the stage for prolonged low-interest rates at the Fed.

AUD/USD is ending Wall Street around the highs of the day, having travelled from a low of 0.6804 to a high of 0.6889. The Federal Reserve interest rate decision started out as looking to be a non-event, with rates held steady at 1.75% vs 1.75% previous, having lowered rates at each of its last three meetings (a cumulative 75 bps of cuts).

However, in its final meeting for the year, Fed Powell doubled-down on his October 30 presser comments when he said he would need for inflation to move up significantly before the need to raise rates again – this is a high bar and he repeated that again today – subsequently, the dollar got whacked.

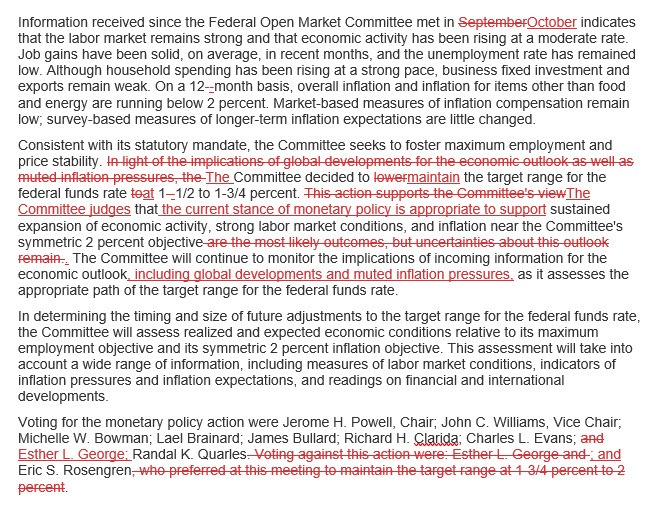

Also, the statement dropped its previous reference to uncertainties about the outlook, though it kept a dovish touch by noting that “global developments and muted inflation pressures” will help determine the future path of monetary policy. On the hawkish side, 13 of 17 committee members expect no change in interest rates in 2020 (the other four see a single hike as likely to be appropriate).

The end result was that the US dollar was sent over a cliff and the wnet on DXY to test a critical support area around 97 the figure. AUD/USD subsequently picked up most demand in the G10s despite the prospects of the 15th December tariff deadline.

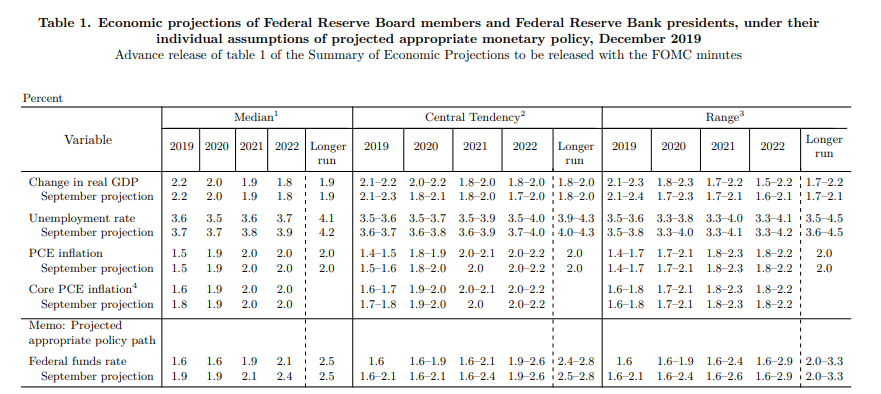

Key takeaways from FOMC statement and projections

- The market has priced in virtually no chance of rate move through February.

- IOER 1.55% vs 1.55% prior.

- Fed drops language about ‘uncertainties about this outlook remain’.

- Vote was unanimous.

- “The Committee will continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures, as it assesses the appropriate path of the target range for the federal funds rate”.

- No changes in the economic outlook paragraph.

- Says “the current stance of monetary policy is appropriate”.

- Leaves forecasts for GDP and inflation unchanged, lowers unemployment.

- Median forecast is for one rate hike in 2021 and one in 2022.

Fed projections

Fed statement changes

Elsewhere, we are expecting an announcement from US President Donald Trump to come before the weekend’s trade tariff deadline. Timing is crucial for Trump as he will not likely do so during US trading on the NYSE if he is indeed implementing the tariffs this weekend. Trump will likely wait for Friday to make such an announcement. If he decides not to, perhaps he will make the announcement before the close on Friday. Whichever way, AUD will be a keen focus and subject to a sell-off should tariffs be implemented – Beijing had warned that they will retaliate.

AUD/USD levels

Having snapped the near-term trend-line resistance, AUD/USD bulls have pressed on and taken to a 78.6% Fibonacci retracement of the Nov swing highs to lows range around 0.6890. The next key target is located at the highs and confluence of the 200-day moving average (0.6911) located at 0.6925. The 0.70 handle is a psychological barrier which holds a 23.6% Fibo of the entire range since 2018 highs and an area that has been significant support on numerous occasions throughout the same period, YTD.