The Australian dollar was being carried down by the strength of the US dollar. The greenback enjoyed an upgrade to GDP, hopes for an approval on a tax cut, and also a relatively positive speech from Janet Yellen.

Fortunately for the Aussie, it had some better-than-expected data of its own. Here are the key figures to watch out for:

- Captial expenditure increased by 1% in Q3, as expected. However, the figure for Q2 was revised up from 0.8% to 1.1%. The investment levels are closely watched by the RBA.

- Australian building approvals increased by 0.9% against a drop of 0.9% that was expected. Year over year, building consents are up by 18.4%.

- Private sector credit is up 0.4%, as expected. Year over year, credit is up 5.3%. This implies future growth.

- The official Chinese manufacturing PMI came out at 51.8, better than 51.5 forecast and 51.6 last time. Also, the non-manufacturing PMI came out above expectations.

All in all, the data hasn’t been extraordinary but mostly positive is also good enough.

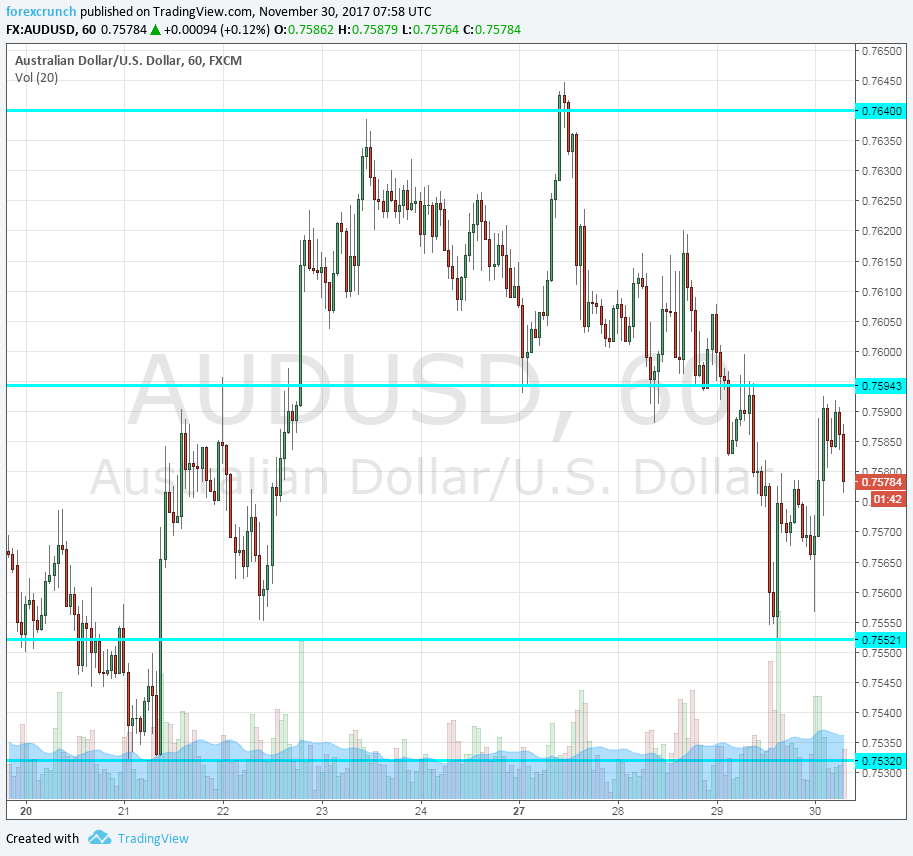

AUD/USD is stable around 0.7575, balanced on the day, while other currencies continue losing ground against the US dollar. Support awaits at 0.7550, followed by 0.7530. Resistance is at 0.7590, and then 0.7640.

More: AUD: Breaking Out Of Ranges On Crosses; What’s Next & How To Position? – Nomura