- AUD/USD trades near 0.7140 during early Asian sessions on Thursday.

- The pair struggles to ahead of the key economic data, namely the quarterly private capital expenditure detail.

- The quarterly private capital expenditure is expected to increase by +0.5% during the fourth quarter (Q4) of 2018 against previous contraction of -0.5% during Q3.

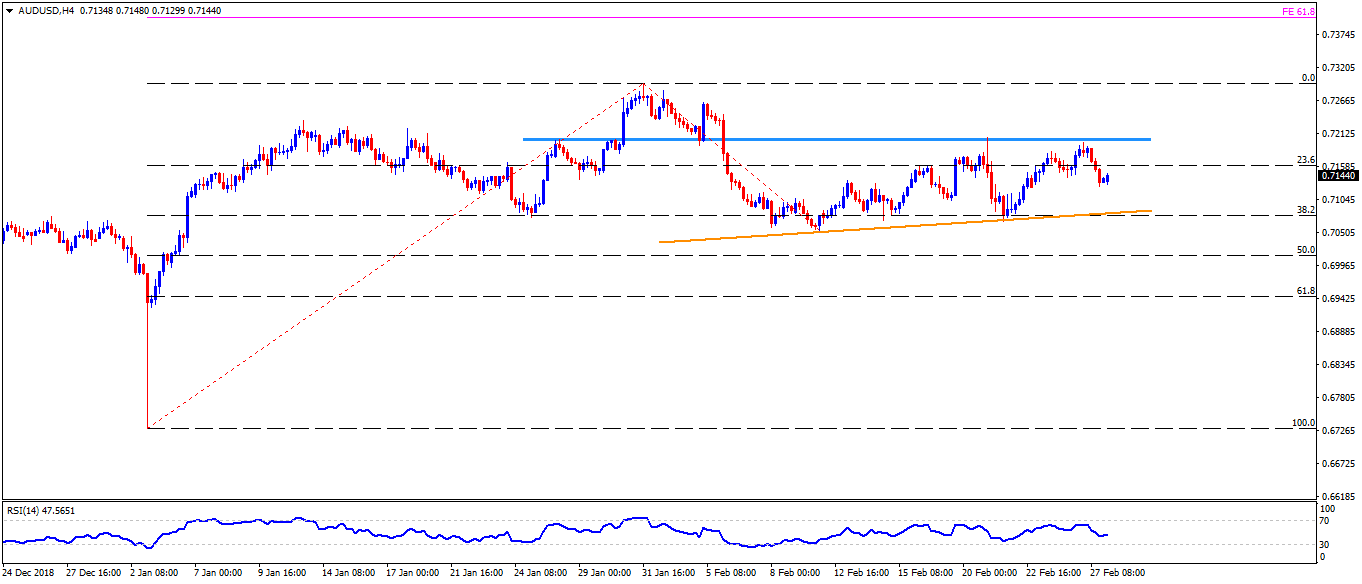

- On the upside, the 0.7200-0.7205 is likely an immediate barrier for the pair before confronting 0.7265 and 0.7300.

- Should there be additional rise by the pair past-0.7300, 61.8% Fibonacci retracement of its Jan-Feb move near 0.7400 can gain market attention.

- Meanwhile, an upward sloping trend-line supports the pair near 0.7080, a break of which can drag it back to 0.7050 and 0.7000.

- During the pair’s additional weakness past-0.7000, 0.6980 and 0.6925 become crucial to watch.

AUD/USD 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 0.7147

Today Daily change: 9 pips

Today Daily change %: 0.13%

Today Daily Open: 0.7138

Trends:

Daily SMA20: 0.7149

Daily SMA50: 0.7133

Daily SMA100: 0.7165

Daily SMA200: 0.7257

Levels:

Previous Daily High: 0.7199

Previous Daily Low: 0.7127

Previous Weekly High: 0.7207

Previous Weekly Low: 0.707

Previous Monthly High: 0.7296

Previous Monthly Low: 0.6684

Daily Fibonacci 38.2%: 0.7155

Daily Fibonacci 61.8%: 0.7172

Daily Pivot Point S1: 0.711

Daily Pivot Point S2: 0.7083

Daily Pivot Point S3: 0.7039

Daily Pivot Point R1: 0.7182

Daily Pivot Point R2: 0.7226

Daily Pivot Point R3: 0.7254