- AUD/USD stays under near-term key resistance-confluence after China data.

- China’s Industrial profits slumped on YoY, unchanged on MoM basis.

Although no major reaction to China’s August month Industrial Profits could be witnessed, AUD/USD remains under short-term key resistance confluence while taking rounds to 0.6750 during early Friday.

China’s Industrial Profits declines -2.0% on a yearly basis versus +2.6% prior whereas MoM reading reprints -1.7% mark.

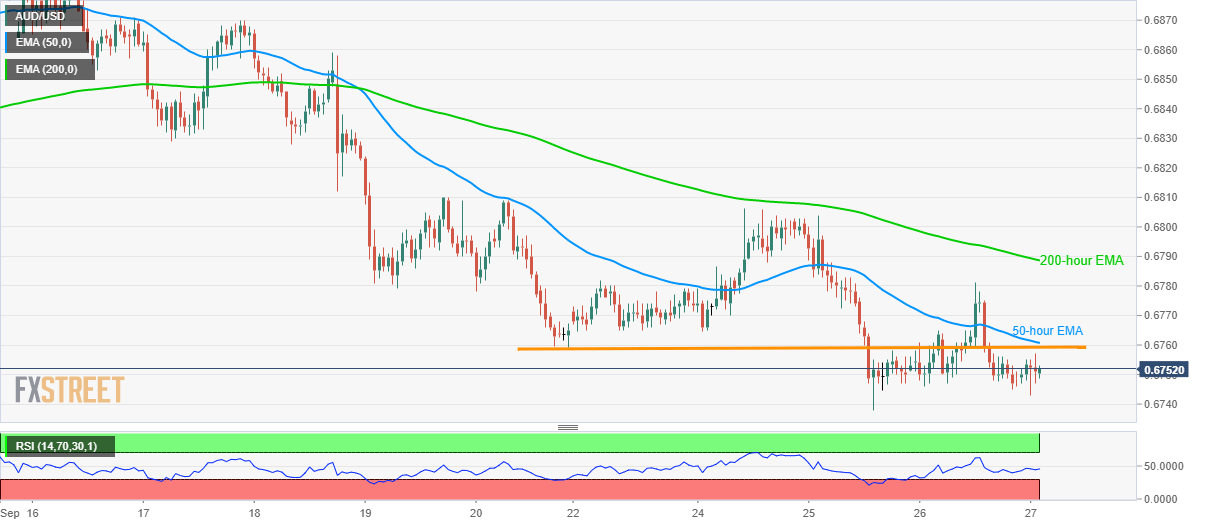

With this, the Aussie pair stays under 0.6858/60 resistance-confluence including 50-hour exponential moving average (EMA) and last-week’s low.

As a result, chances of its further declines to 0.6700 round-figure and then to the monthly bottom close to 0.6690 seem brighter.

Meanwhile, pair’s run-up beyond 0.6760 could please buyers with 0.6780 before confronting 200-hour EMA level close to 0.6790.

AUD/USD hourly chart

Trend: bearish