The Australian dollar has never really managed to recover from the poor GDP read, and finds other reasons to fall. What’s next for the Aussie?

The team at Barclays sees further weakness coming sooner rather than later:

Here is their view, courtesy of eFXnews:

Barclays expects much of the weakness in the AUD to be front loaded, taking place over the next few months, in line with the RBA’s desire to see the currency drop to around 0.80 US cents.

“Indeed, given that: 1) the market is already very short AUD; 2) technically; AUD is looking oversold; 3) the move in AUDUSD has brought it back in line with 2y yield differentials; 4) China growth is moderating, but policy stimulus will limit any sharp decline in growth; and 5) our more-hawkish-than-market forecast for RBA rate hikes, we do not expect the AUD to weaken at anywhere near the same pace further out,” Barclays argues.

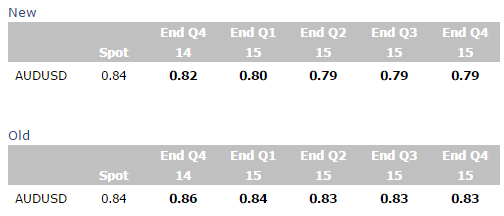

Consequently, Barclays has revised its forecasts as follow:

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.