The Australian dollar was seen trading lower against most major currencies, including the US dollar and the Japanese yen. The AUDJPY pair broke an important support area and traded lower below the 95.00 level.

Fundamentally, the Chinese GDP data was released earlier during the Asian session, which registered better than expected readings. The report published mentions that the Chinese GDP grew by 2% in the second quarter of 2014, beating the expectation of a 1.8% rise. However, the negative sentiment prevailed in the market, as the Australian dollar dived across the board.

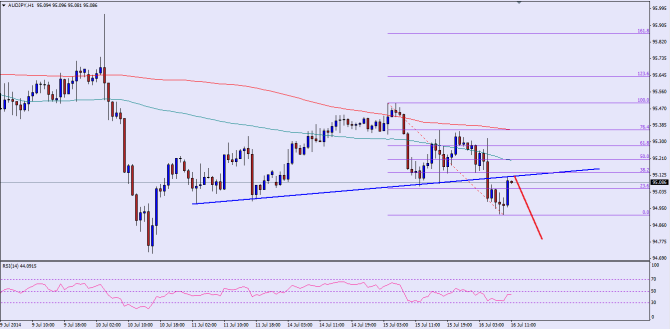

There was a critical trend line on the hourly chart for the AUDJPY pair. The pair broke the highlighted trend line and traded lower to trade as low as 94.91. Currently, the pair has retraced back some of the losses and retesting the broken trend line, which is now coinciding with the 38.2% fib retracement level of the last drop from the 95.50 high to 94.91 low. It looks difficult that the pair might trade back above the trend line. However, if that happens, then next resistance can be seen around the 100 hourly moving average, which is coinciding with the 50% fib level. So, sellers are likely to appear around the 95.10-20 levels.

If the pair fails around the mentioned levels, then a run towards the recent low of 94.91 might be possible. If sellers take control, then they might break the 94.90 support level to challenge the 94.70 low.

Overall, as long as the pair is trading below the 100 hourly moving average selling rallies looks like a good option in the short term. The hourly RSI is also below the 50 level, which can be considered a negative sign.

Posted By Simon Ji of IKOFX