Technical Bias: Bullish

Key Takeaways

“¢ Australian dollar remains elevated against the New Zealand dollar.

“¢ Possible inverse head and shoulders formation might the AUDNZD pair higher.

“¢ USDJPY support at 1.0800, and resistance at 1.0870.

Australian dollar after failing around the 1.0880 resistance zone has moved lower against the New Zealand dollar. However, the pair found buyers to hold an important support area, which suggests that it might gain traction again in the short term.

Technical Analysis

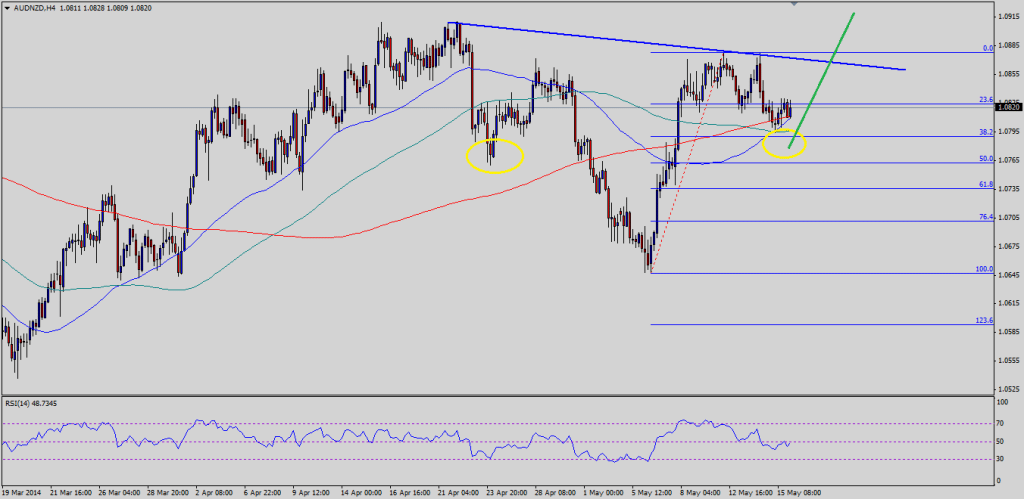

The AUDNZD pair traded higher towards an important resistance zone earlier during the week. The pair found sellers around a critical bearish trend line connecting all recent swing highs. The failure to break the trend line resulted in a move lower towards a confluence support area of all three key simple moving averages (200, 100 and 50) on the 4 hour timeframe. The 38.2% Fibonacci retracement level of the last leg higher from the 1.0654 low to 1.0879 high also sits around the same confluence zone. Currently, the pair is consolidating around the mentioned support area. However, if we analyze closely, then there is a possibility of an inverse head and shoulders pattern formation if the pair dips close to the 50% fib level. If this pattern takes hold, then a move higher towards the 1.0900 is possible in the coming days. A break and close below the 61.8% fib would invalidate this pattern.

Moreover, it cannot be denied that the pair might find sellers again around the highlighted trend line. Any failure to break the trend line could ignite a fall in the AUDNZD pair moving ahead. In the near term, the support area of all three key SMA’s hold the key for the pair. If buyers give up, then it would be interesting to see how the pair reacts around the 50% fib level.

Overall, the market sentiment still favors more gains in the AUDNZD pair. However, this could easily change if the pair drops below the important support area moving ahead.