Technical Bias: Bullish

Key Takeaways

“¢ Australian dollar looks like correcting recent gains against the New Zealand dollar.

“¢ Higher than expected Australia’s retail sales figure might lift the Australian dollar.

“¢ AUDNZD support seen at 1.0910 and resistance ahead at 1.0975

The New Zealand dollar after losing ground heavily against the Australian dollar managed to gain some bids recently, but that can only be seen as a part of the correction.

Technical Analysis

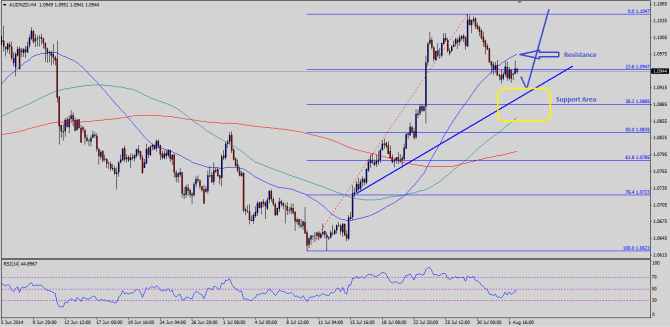

The AUDNZD pair traded as high as 1.1047 during this past week before finding sellers. Currently, the pair is approaching a bullish trend line on the 4 hour chart, which might act as a barrier for the Australian dollar sellers. The mentioned trend line also coincides with the 38.2% Fibonacci retracement level of the last move higher from the 1.0623 low to 1.1047 high. So, there is a chance that the pair might gain bids around the 1.0910 area. The 100 simple moving average is also aligning itself around the mentioned support area. So, it highlights the importance of 1.0910 area. A break below the mentioned support level might take the pair towards the 50% fib level or a test of the 200 SMA – 4H is also possible. One of the main hurdles for the Aussie buyers is that the RSI on the 4 hour timeframe is still below is the 50 mark.

Alternatively, if the pair trades higher from the current or a bit lower levels, then a run towards the last high of 1.1047 is possible. A break above the same might take the pair towards the 1.1100 resistance area.

Australia’s Retail Sales Data

Earlier during the Asian session, the Australia’s retail sales data released by the Australian Bureau of Statistics. The forecast was of 0.4% increase. However, the outcome was on the positive side, as the Australia’s retail sales rose 0.6% in June 2014 in seasonally adjusted terms.