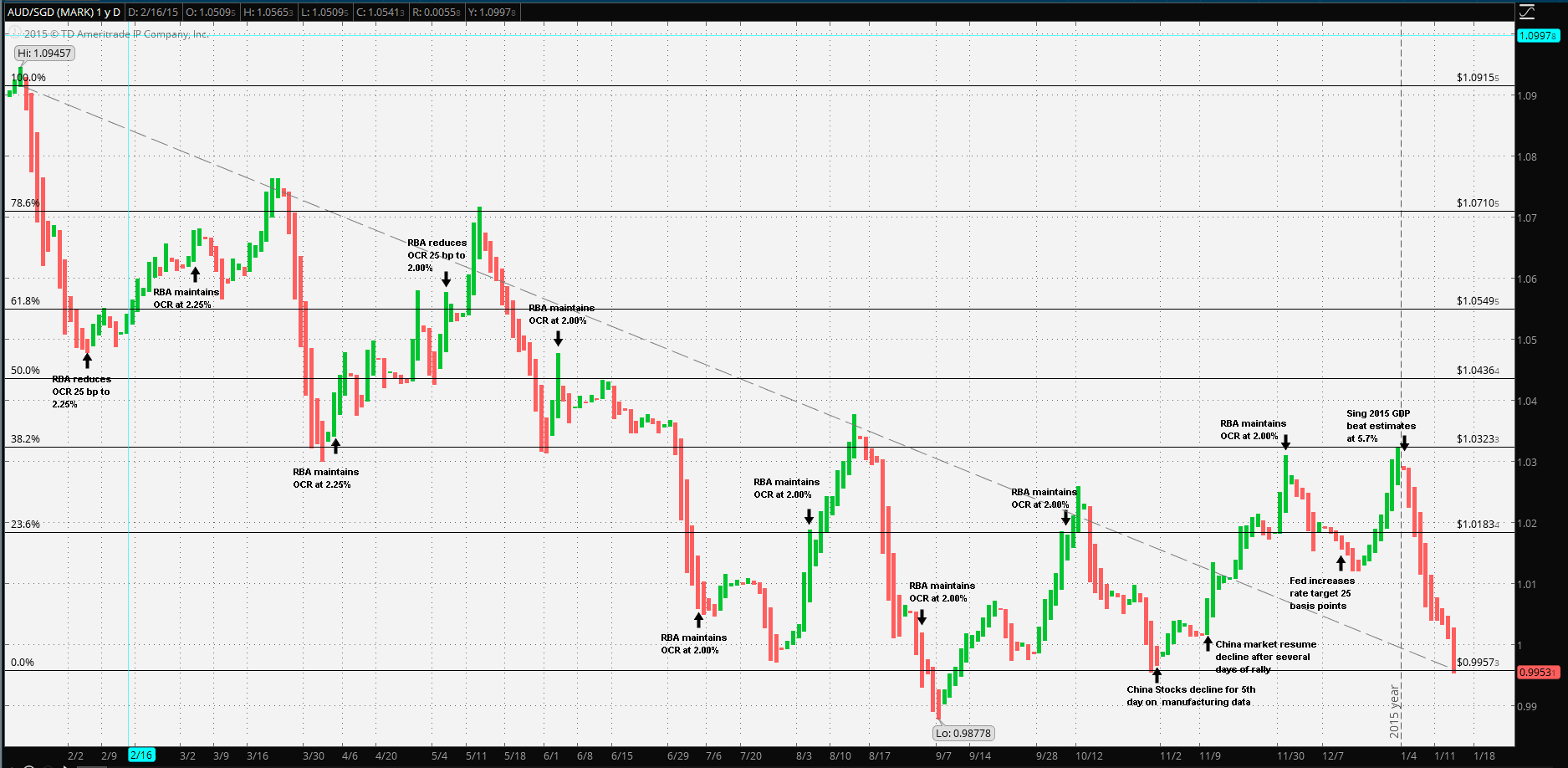

The Reserve Bank of Australia has been steadfast in its 2.00% cash rate policy in spite of the continuing regional economic contraction impacting Australia’s commodity export economy. At the 1 December meeting RBA Governor Glenn Stevens’ statement began with an upbeat tone but the challenges faced by the economy did not go unnoticed: “…available information suggests that moderate expansion in the economy continues in the face of a large decline in capital spending in the mining sector… …Inflation is low and should remain so, with the economy likely to have a degree of spare capacity for some time yet… …In such circumstances, monetary policy needs to be accommodative. Low interest rates are acting to support borrowing and spending…“

Guest post by Mike Scrive of Accendo Markets

Most important was the board’s assessment of the efficacy of the current policy and the RBA capacity to ease further if needed: “…the Board again judged that the prospects for an improvement in economic conditions had firmed a little over recent months and that leaving the cash rate unchanged was appropriate. Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand…” It’s important to note that this was the consensus of the board before the Fed’s 16 December decision, the sudden correction in China’s stock markets and the continuing decline in petroleum, copper and other strategic commodity prices.

The RBA seemed to have made the right call by holding rates at 2.00% since last May, risking an further acceleration in real estate prices in the process. However, the gamble paid off, housing prices halted its worrying acceleration leaving the RBA with a comfortable 2.00% cash rate to leverage if needed. It’s important to note that the news hasn’t been all downbeat. Auto sales have been continuing at a record pace; a good indication of consumer spending. There have been recent concerns that Australia’s top quality debt ratings would be affected by domestic household debt, terms of trade and the effect of commodity prices on domestic industries. There have even been official reductions of expected GDP growth from 3.00% to 2.27%, however the economy still tends to surprise on the upside.

The point of the matter is this: the Aussie economy is certainly being impacted by the slowing demand for strategic commodities and there still are rough seas ahead. However, the economy seems to be maintaining a moderate level of growth without any associated inflation, including in the once booming housing market. The RBA maintenance of policy with a 2.00% OCR had been spot on and gives the central bank the leverage to reduce rates when and if needed. Hence, there’s a strong likelihood that the Aussie economy will be able to handle the regional restructuring at least for the near term and, perhaps, without further OCR reductions.

There’s a great deal to admire about the Singaporean economy. It’s fair to say that Monetary Authority of Singapore has created a ‘designer monetary policy’, optimizing the best assets of the Sing economy: its financial services sector, strategic geographic location, port infrastructure, petroleum storage and refining capacity and the ease of doing Business in Singapore. However, the same dynamism which adapted to quickly to growth opportunities is less able to respond when the economy needs to unwind from foreign investments. The MAS is ever present in FX markets and acts when needed to maintain price stability and remain competitive in export markets. However, over the past two decades, the Sing economy may have become a bit too heavily weighted towards the Chinese economy. It has been estimated that for each 100 basis points decline in China GDP, the Singapore’s economy will decline anywhere from 100 to 150 basis points. To be sure, China is still generating a lot of growth but that growth is slowing.

Hence the MAS is faced with a multitude of problems which all point in the same direction. The entire region is readjusting its growth outlook; there’s a lower level of commodity demand as well as a lower volume of traffic passing through its Singapore ports. Hence, the MAS may have no other choice other than to ratchet down the Sing Dollar relative to its primary trade partners in order to keep its manufacturing and services sector from contracting further. However, as the chart clearly demonstrates, the MAS has certainly not yet intervened. Is this a flight-to-quality reaction? Or has the Aussie been very oversold? Also it’s worth keeping in mind that the MAS and PBOC have a special standing currency swap facility.

Still how much more can the Sing strengthen against the Aussie, when the RBA has an overnight rate of 2.00% vs the MAS standing facility of 0.11%? Even if the conservative acting RBA reduces 25 basis points, at best, the OCR ratchets down to 1.75%. The only other high quality carry in the region is for the RBNZ 2.50% OCR which has the potential to ratchet down to 2.25%.

It seems unlikely that the Sing Dollar will continue to strengthen against the Aussie; however, one must keep in mind that irrational relationships do form in chaotic markets.

The next RBA meeting is scheduled for early February. Should the RBA maintain its 2.00% OCR, it’s likely that the Sing dollar will reverse its current trend vs the Aussie, if not before and remain in the $1.00 support to $1.0436 resistance range.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“