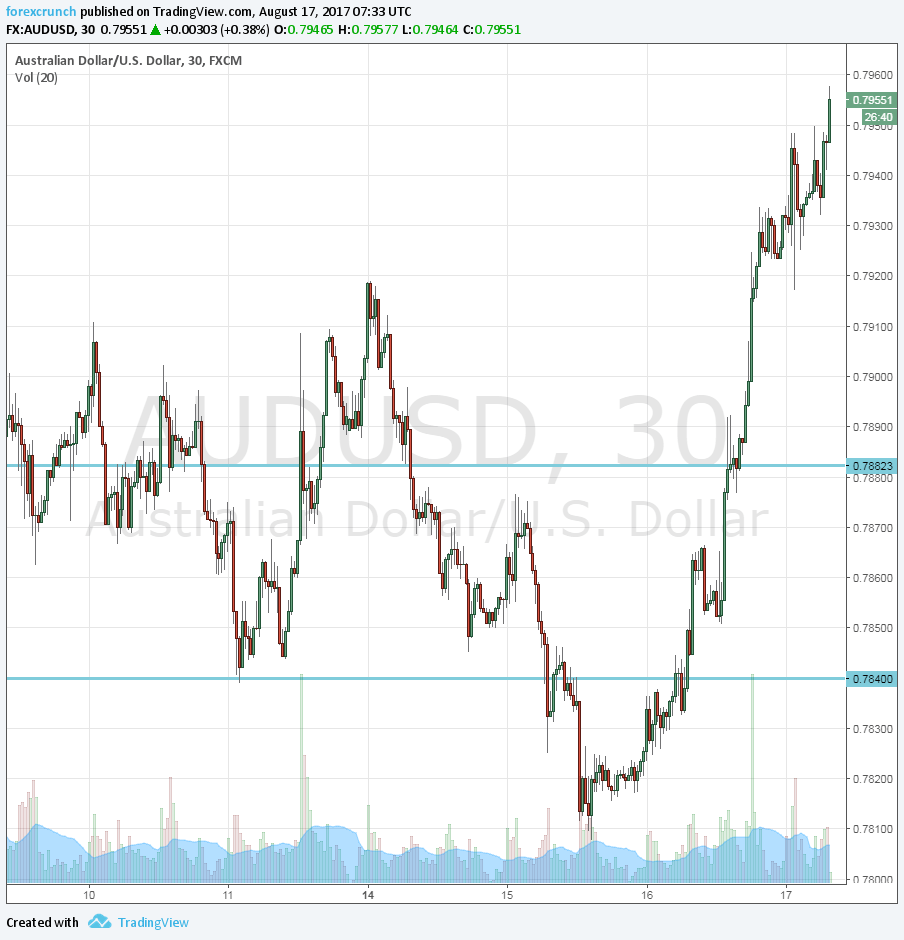

The Australian dollar is on a recovery path. After dropping under the important support line of 0.7835, the pair is making its way back up.

The Australian jobs report is the main driver, but also the weakness of the US dollar contributes.

Australian labor market

Australia’s jobs report was mostly positive. The nation of the land down under reported a gain of 27.9K, better than 20K expected. This came on top of an upwards revision for the previous month: 20K instead of 14K originally reported.

The data shows a robust and steady jobs market throughout 2017. The unemployment rate remained at 5.6% with a participation rate of 65.1%, above 65% seen last time.

The only downside in the report came from the composition of jobs, which is quite volatile. Over 20K full-time jobs were lost while part time jobs are up over 48K. This is a mirror image of the changes seen in June.

USD weakness – levels to watch

The greenback is falling a toxic mix of poor US housing data, a hesitant Federal Reserve as seen in the meeting minutes, and the ongoing political trouble of Trump. He lost his business advisory councils.

The data can still improve and the various Fed speakers can offer different points of view, but Trump is finding it hard to dig himself out of the hole.

AUD/USD is currently trading at around 0.7960. The next level is easily 0.80, followed by the cycle high of 0.8065. 0.8165 is the next level far above.

Support awaits at 0.79 in the case of a pullback and 0.7835 remains relevant. The break below that line looks like a “fake out”.