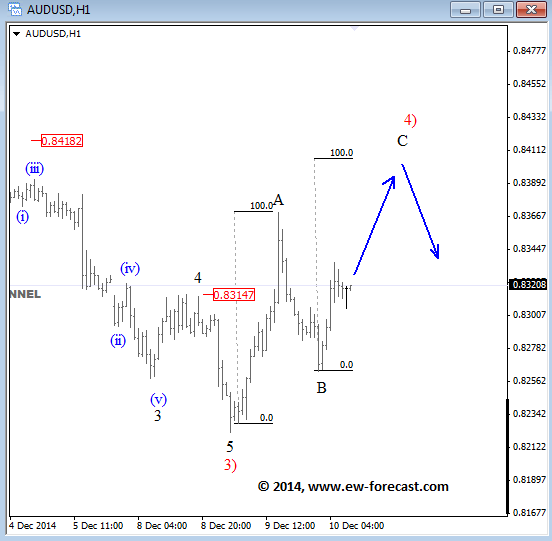

AUDUSD found support yesterday about which we warned you in our past update with those five sub-waves down in red wave 3). We know that after five waves the market will make a three wave movement into the opposite direction. For now, the bounce from the low is still in three legs, but it seems to be underway with wave C now in view towards 0.8400 where the contra-trend reaction of red wave 4) could look for resistance.

AUDUSD 1h Elliott Wave Analysis

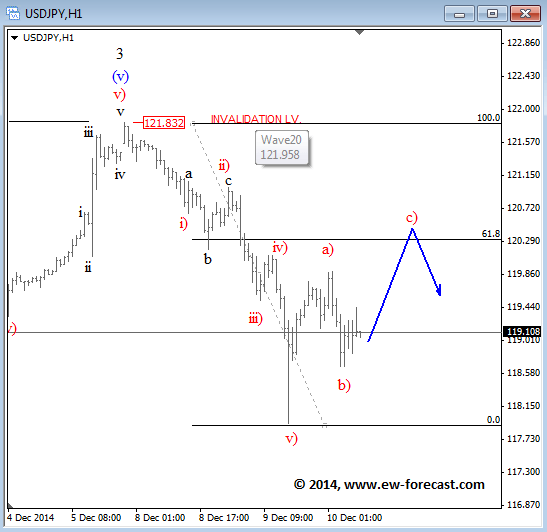

The decline on USDJPY can be counted in five waves, so we need to be aware of more downside after a three wave bounce. We are looking at a zigzag with wave c) now in progress towards the 120/120.50 resistance area. Once those levels are reached, we could see a bearish turn for 117.00 while the 121.83 high must stay in place.

USDJPY 1h Elliott Wave Analysis