The Australian dollar was already weaker on growing expectations for a rate cut in Australia due to lower inflation. And then came the Fed, basically hinting of a rate hike in December.

AUD/USD ended its recovery and slopped around 80 pips to 0.7080. A “dead cat bounce” results in the pair struggling to recapture the 0.71 handle. Will we see a challenge of 0.71?

What did the Fed say? Well, it added a mention of its “next meeting” in the context of the rates. This didn’t appear in the text beforehand. In addition, markets had expected the Fed to put off a 2015 rate hike due to weak data: Non-Farm Payrolls, retail sales, durable goods orders and what-not came out under expectations.

So, in this sense we had a big hawkish surprise, and we also received a generally positive picture of the economy. Janet Yellen and her colleagues did not ignore the negative data, but took one step back and saw the positives as well.

In Australia, the economy is still vulnerable to the Chinese slowdown and this doesn’t bode well for the A$.

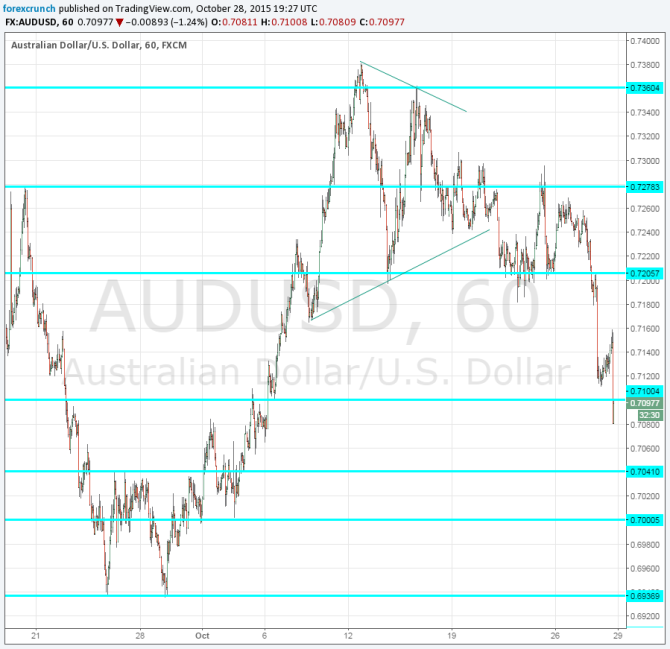

Here is the AUD/USD chart. Further support awaits at 0.7040, followed by 0.70 and the double bottom at 0.6935.