The better market mood has helped both antipodean currencies but the road is certainly bumpy. What do the technical lines say? Here is the view from NAB:

Here is their view, courtesy of eFXnews:

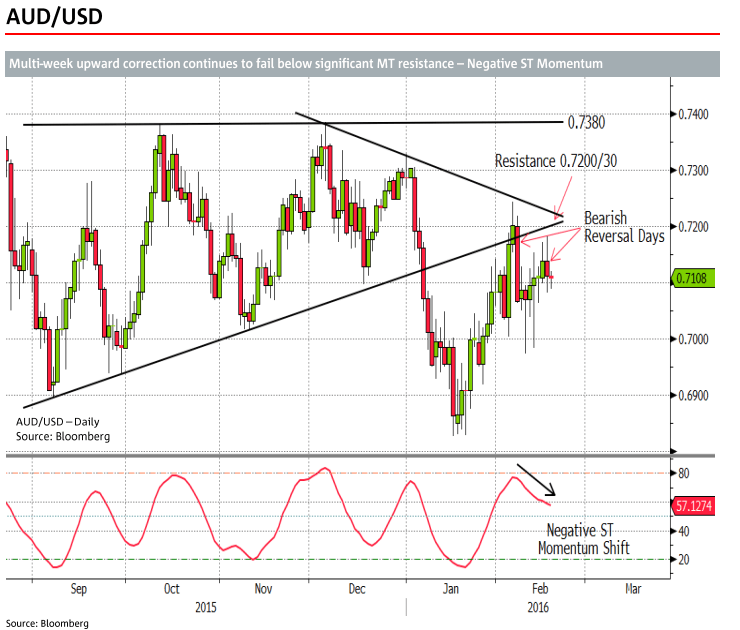

The corrective bounces of recent weeks have challenged the integrity of the downtrend but not broken its structure. Dual trend line resistance at o.7200/30 has proven too strong on both attempts and resulted in price completing bearish ST reversal patterns.

While price remains below the base of the broken multi-month triangle/consolidation we consider the MT downtrend to remain in play.

Note that AUDUSD has traded in a broad sideways consolidation since mid-2015, highlighting a stark reduction in the pace of the downtrend.

As such we see risk of a decline towards the bottom of the 2015/2016 range, however we are reluctant to be aggressively bearish beyond a multi-week timeframe without seeing renewed negative triggers at a MT level.

The January close in NZD/USD was the lowest monthly close since September 2015 and completed a bearish monthly candle pattern confirms a renewed multi-month downtrend bias after five month of consolidation.

As such the upward corrections of the last two weeks have failed to overcome significant trend line resistance at 0.6710/40. The daily reversal patterns (bearish engulfing day) completed each occasion imply a bearish ST bias.

A more powerful bearish confirmation would come from a close this week below 0.6488. A series of previous highs at 0.6555/60 are providing ST support. A daily close below this level should set up a larger decline.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.