The euro and the Australian dollar have both been on the back foot, but this may not be the end.

The team at Credit Suisse provides updated technical setups and charts for both EUR/USD and AUD/USD:

Here is their view, courtesy of eFXnews:

The following are the latest technical setups for EUR/USD, and AUD/USD as provided by the technical strategy team at Credit Suisse.

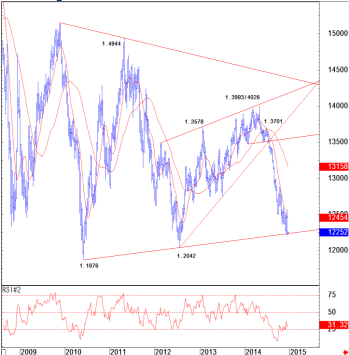

EUR/USD: The trend stays bearish to test the more important 2012 low at 1.2042.

EURUSD remains on the back foot prodding to new cycle lows. This leaves the focus immediately lower on trend support from early October at 1.2166 next. Beneath here looks to 1.2134, and then the 1.2042 low of 2012. Below this latter level would complete a much more important top to target the June 2010 low at 1.1876 next.

Resistance moves to 1.2273 initially, then 1.2302, ahead of 1.2353, which we look to try and cap. Above can see a recovery back to 1.2415/18.

CS maintains a short EUR/USD position with a stop at 1.2355 and a target at 1.2045.

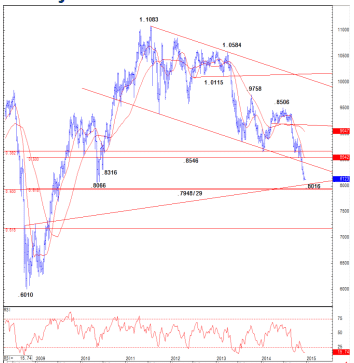

AUD/USD: We remain bearish for our core bear target at .8066, where we look for buying to start to show.

AUDUSD has once again pushed lower to a new cycle low, and while still capped below the near-term downtrend at .8176, the immediate risk is seen directly lower through .8082. This should then see an extension of weakness towards our core target from the low of 2010 at .8066, potentially as far as trend support at .8019, where we would look for an attempt to base. Beneath here though can keep the immediate risk lower for .7948 – the 61.8% retracement of the 2008/2011 uptrend.

Above .8175/76 can see a move towards .8204/06 and then .8237/39 where we would look to find selling.

CS maintains a short AUD/USD position from .8350, targeting .8080.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.