The Australian dollar enjoyed a positive inflation read among other reasons, and advanced. What do the charts tell us?

Here is their view, courtesy of eFXnews:

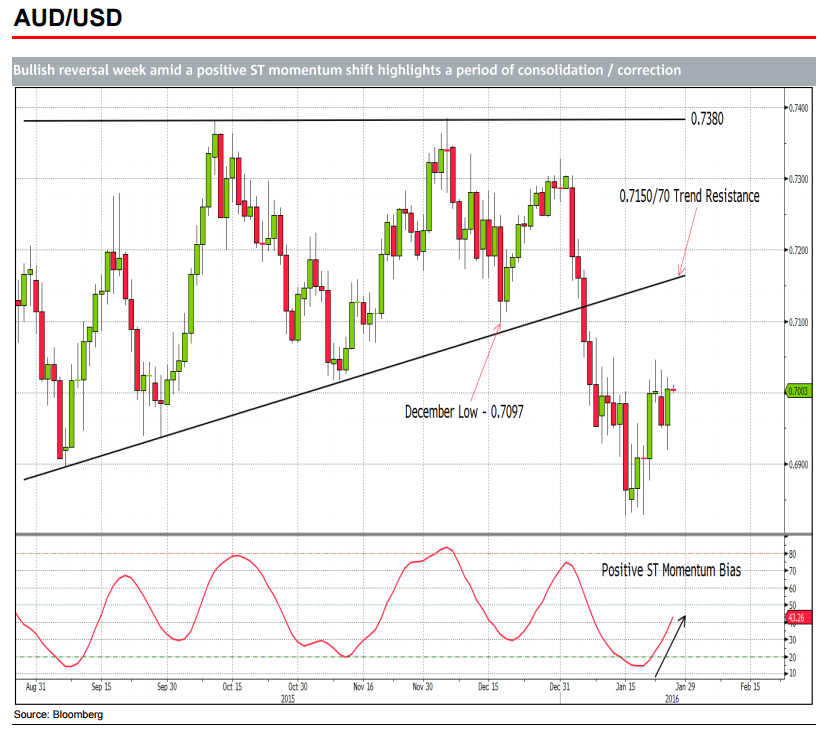

Trend: The recent bounce completed a bullish weekly reversal pattern last week that implies exhaustion in the downtrend and the need for a further period of consolidation/correction. Tuesday’s dip held above ST 61.8% retracement support at 0.6911 (low 0.6919) and the strong close completed a ST continuation pattern, confirming an uptrend bias in the ST.

While the likelihood of further ST gains is high, only a weekly close above the broken triangle base at 0.7150/70 would negate the MT downtrend. A January month end close below 0.7000/20 would complete a further LT bearish continuation pattern and trigger a more bearish multi-month outlook.

Momentum: ST Momentum has shifted to a positive bias implying further consolidation/correction in the near term. MT momentum remains negatively biased, highlighting the MT downtrend.

Outlook: Directional bias is now highly conflicted across time frames. As such, price has entered a consolidation/correction phase. 0.6900/30 support should be a firm base in the coming days ahead of further correction towards 0.7100/50. A resumption of the downtrend will depend upon the price response to these upper levels and a return to a negative ST momentum bias.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.