The Australian dollar had a nice run, climbing to levels last seen in June and even temporarily peeking over high resistance. However, this was short-lived.

Australia lost 10.8K jobs in August, while it was expected to gain around the same amount. The unemployment rate rose from 5.7% as expected, but underlying numbers are somewhat more troubling.

The participation rate dropped from 65.1% to 65%, contrary to predictions of a rise. This is the lowest since January 2007. For reference, the participation rate in the US is at levels last seen in 1978. Australia lost 2.6K full time jobs and 8.2K part time jobs.

AUD/USD

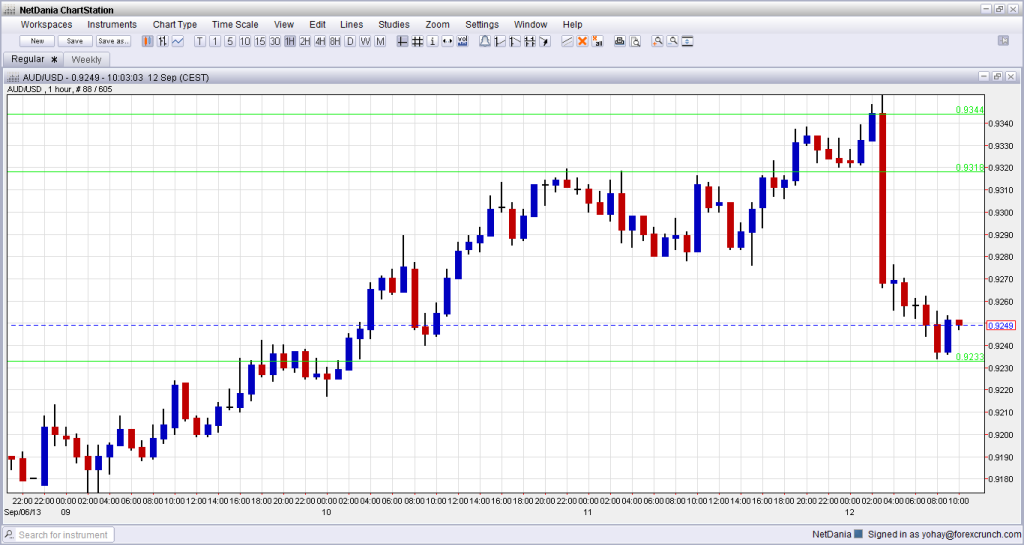

Aussie/USD settled above the 0.9318 line and even broke above the 0.9344 level which was the high of late June. So the pair reached a full 3 months high just before the publication.

But the reaction was harsh for the Aussie: the pair dropped immediately after the publication and continued diving until it reached the 0.9233 line – a double top in August. Further support appears at 0.9115.

It is important to note that there are other reasons for the Aussie to rise. Among the 5 reasons for the Aussie’s rise, one was the run-up to the employment data, and this is now erased.

For more, see the Australian dollar forecast.