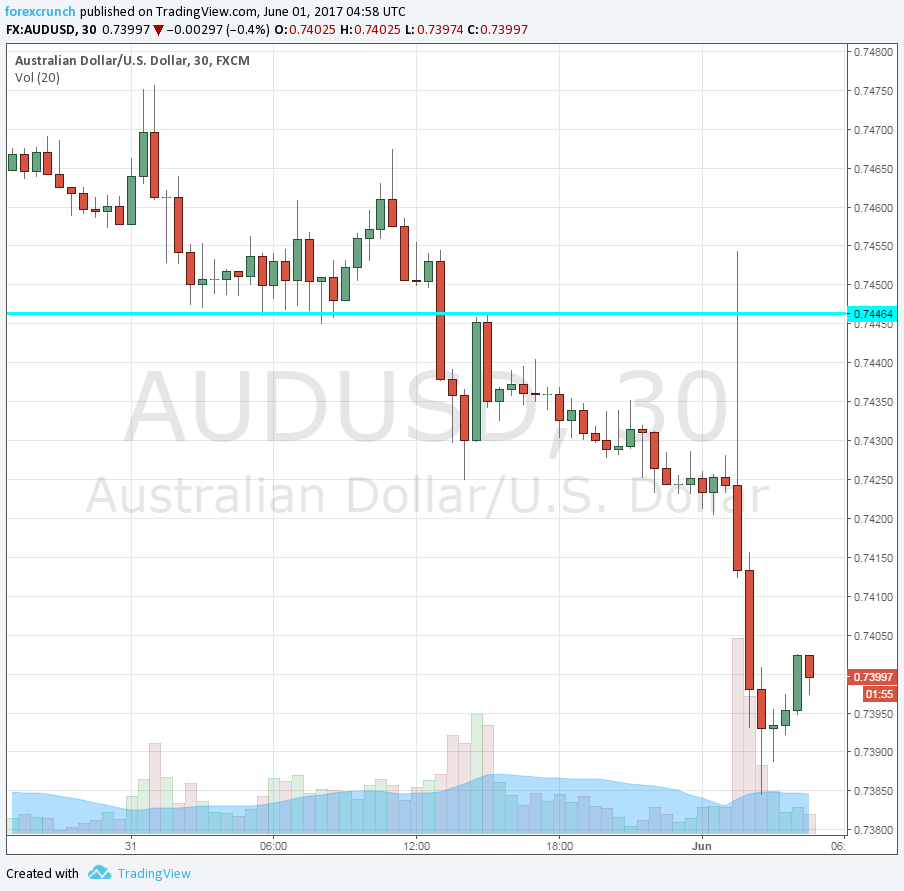

Aussie/USD is struggling to hold onto the 0.74 level. The pair dropped to 0.7385, just above support at 0.7375. A further cushion awaits at 0.7325.

Chinese data has the upper hand. The independent measure of China’s manufacturing sector now reflects a contraction in the sector. The Caixin manufacturing PMI fell from 50.3 to 49.6, more than 50.2 expected. The 50 point mark is the threshold separating expansion and contraction.

A slowing manufacturing sector means that Australia’s metal exports will receive less demand. This is the first contraction in 11 months. And what about Australia?

Australian data is actually OK

Quarterly private capital expenditure rose by 0.3% in Q1, marginally below the rise of 0.4% expected, but with a significant upward revision: a drop of only 1% against 2.1% originally reported.

Australian consumers are also upbeat: an advance of 1% in consumption against a fall of 0.2% beforehand, a minor revision from a slide of 0.1% initially published.

A point of worry could come from the CoreLogic house price index, which showed a drop of 1.1%. An overheating housing sector has always been a source of worry but usually pushed to the backburner.

AUD/USD prefers the downside

China is the world’s second-largest economy in the world and Australia’s No. 1, trade partner is largely responsible for the fact that Australia hasn’t had a recession since the early 90s.

And in 2017, we can easily observe that the data from China overwhelms top-tier domestic data.

AUD/USD faces support at 0.7375, which is quite close, followed by 0.7325. Below, 0.7250 is a very strong level of support. Looking higher, 0.7450 is resistance, followed by the round number of 0.75.