The Australian dollar showed its resilience to some underwhelming data. The RBA left rates unchanged as expected and warned about the strength of the exchange rate. Australia’s trade balance surplus came out below expectations.

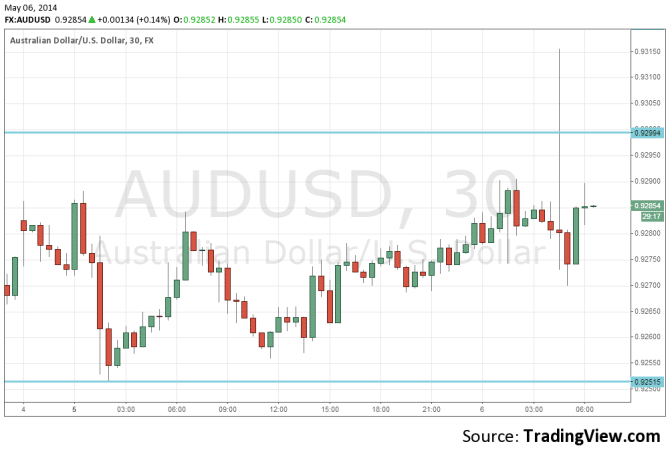

Nevertheless, not only did the pair refrain from falling, but even spiked higher and crossed the round 0.93 line to reach 0.9315 before getting back to range.

Here is how the spike looks on the chart:

Australia reported a trade balance surprise of 731 million in March, lower than 1.2 billion expected and 1.257 billion in February. In addition, the volume of exports shrank by 2% while imports remained flat after rising in the previous month.

This data did not have a significant impact and then came the RBA. Glenn Stevens and co. left the interest rate at 2.50% as widely expected and once again noted the exchange rate. Here is a quote from the statement: “The exchange rate remains high by historical standards.”

Owing in part to thin liquidity due to a holiday in Japan, AUD/USD shot up from 0.9280 to 0.9315 and eventually returned to range, but not lower.

Support is found at 0.9250 and resistance lies around 0.93. For more, see the AUDUSD prediction.