The weakening of the US dollar has been seen across the board, but perhaps the most pronounced move is against the Australian dollar.

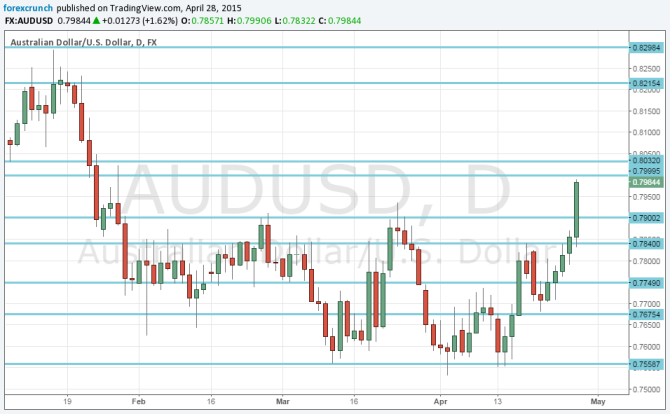

AUD/USD is trading just under the very round level of 0.80. Break or bounce? And what levels should we look at?

The Australian dollar still enjoys strong employment numbers and now also some speculation that the RBA will refrain from cutting once again, especially as inflation is firmer. This Aussie strength was accompanied by USD weakness, that just got another punch from weak consumer confidence.

The latter move sent the pair to a high of 0.7990, just 10 pips from the very round number, which is obvious resistance.

Quite close by, the 0.8030 level provided support back in January and is immediate resistance, especially in the case of a false break above 0.80.

The next resistance lines are further along: 0.8215 capped the pair early in the year, and the round 0.83 level was the last run of the pair before collapsing. Further above, we find 0.8360 and 0.8420.

On the downside, 0.79 is a round number that also worked as resistance in February. 0.7840 had the same role in April. The next level is 0.7750 which was a gap line, and 0.7675 which was the bouncing point.

Here is the chart: