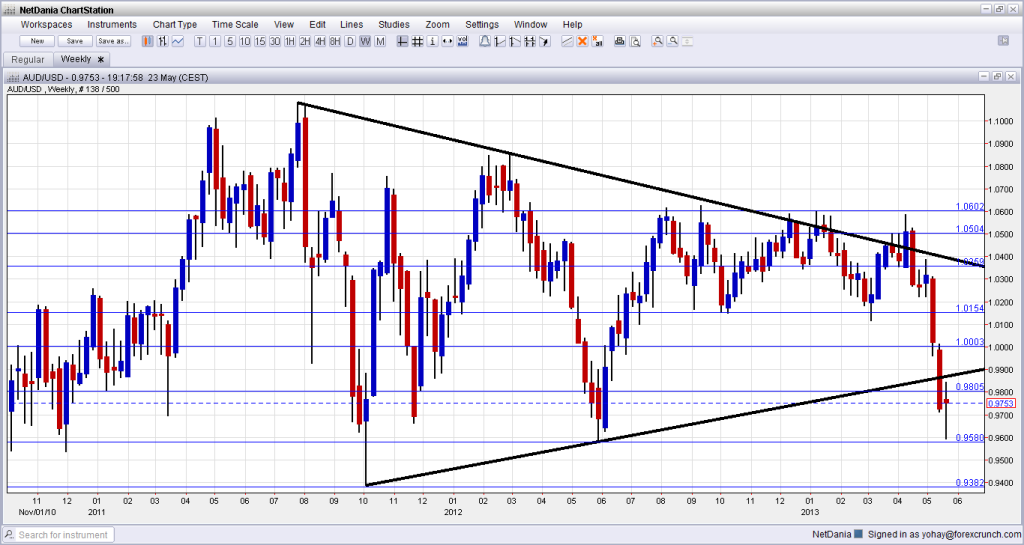

The Australian dollar had a wild ride: at first, it extended its drops, reacting to weak Chinese data. The pair dropped as low as 0.9594, only 14 pips above the low seen in early June 2012.

From there, the Aussie turned 180 degrees and rose by around 180 pips, finding itself shy of 0.9780. Does this hammer pattern suggest that the Aussie bottomed out? Or given the wild market moves, can it go down under once again?

Apart from Chinese data, the Aussie certainly has internal reasons to fall, with the report on a peak in mining investment being the most worrying one. Ford added by announcing it will close a plant in Melbourne.

And the US dollar had reasons to ride on Bernanke’s open to door tapering QE later this year. However, despite better than expected numbers in the US jobless claims and then in the new home sales, the dollar took a break and corrected the previous moves.

One of the reasons is that some market participants understood that tapering of QE will not come so soon and that conditions certainly apply.

AUD/USD already had a hammer pattern a few months ago: it fell under 1.0150 (which served as important support), just to shoot back up into the range. That was a false break that provided a buy opportunity.

Here is the weekly chart that shows these hammers:

We could be witnessing the same move here, but it’s important to note that the wild moves of AUD/USD are part of a larger context: the US stock market reached new highs and plunged. This was followed by a crash of 7.32% in Japan’s Nikkei index. USD/JPY reached mutli year highs, and USD/CAD broke to higher ground. GBP/USD barely escaped the round number of 1.50.

These days aren’t normal, and another surge of the dollar with or without the new talk of tapering could send the Aussie lower.

For more lines, events and analysis, see the AUD to USD forecast. And here is a live hourly chart of AUD/USD:

[do action=”tradingviews” pair=”AUDUSD” interval=”60″/]