The RBA did not rock the boat and the Aussie held its ground. What’s next?

Here is their view, courtesy of eFXnews:

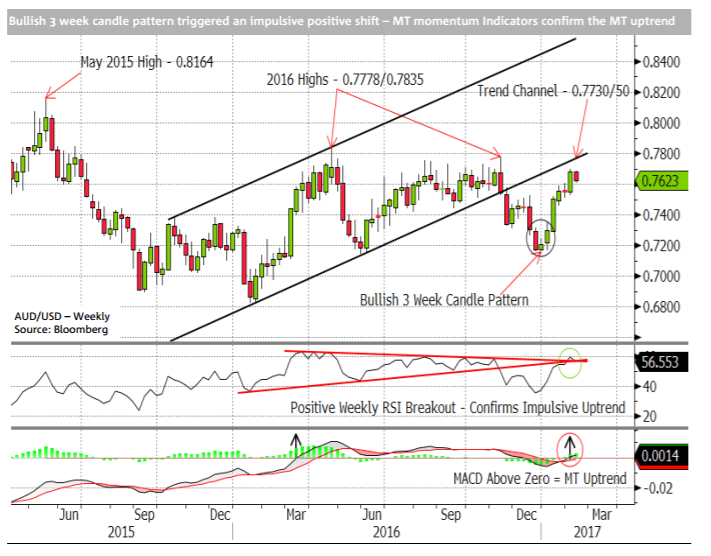

Trend: Price broke down from its broad 2016 triangle in Q4 2016 and challenged the bottom of the nine-month range and our downside target at 0.7150/00 in December. The response to nine-month lows at 0.7150/00 has been positive however, setting up an impulsive bullish reversal pattern in January. On a multi-week basis the interim uptrend justifies a retest of the base of the broken LT uptrend channel at 0.7730/50 (high last week of 0.7696). Beyond this we note 2016 highs at 0.7778/0.7835 as a difficult hurdle that would need to be overcome in order to establish a more sustainable MT uptrend. This would target the May 2015 high above 0.8150 at a minimum.

Momentum: MT momentum shifted to a positive bias in January after achieving a material unwind towards oversold levels. Weekly RSI overcame two key trend lines last week while the weekly MACD broke above zero. These are powerful confirmations of the MT uptrend bias. ST momentum highlights some near term stress indicative of a ST consolidation ahead of a resumption of the uptrend.

Outlook: Price achieved our downside target at 0.7150/00 in late December before launching an impulsive uptrend in January. Bullish monthly reversal pattern in January confirms that the Q4 decline was most likely a correction and implies a reassertion of the MT/LT uptrend. Current upswing has fallen marginally short of our initial target (trend channel base at 0.7730/50). A weekly close above 0.7730/50 will target a challenge of 2016 highs at 0.7778/0.7835 and ultimately 0.8150/0.8300 in the MT.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.