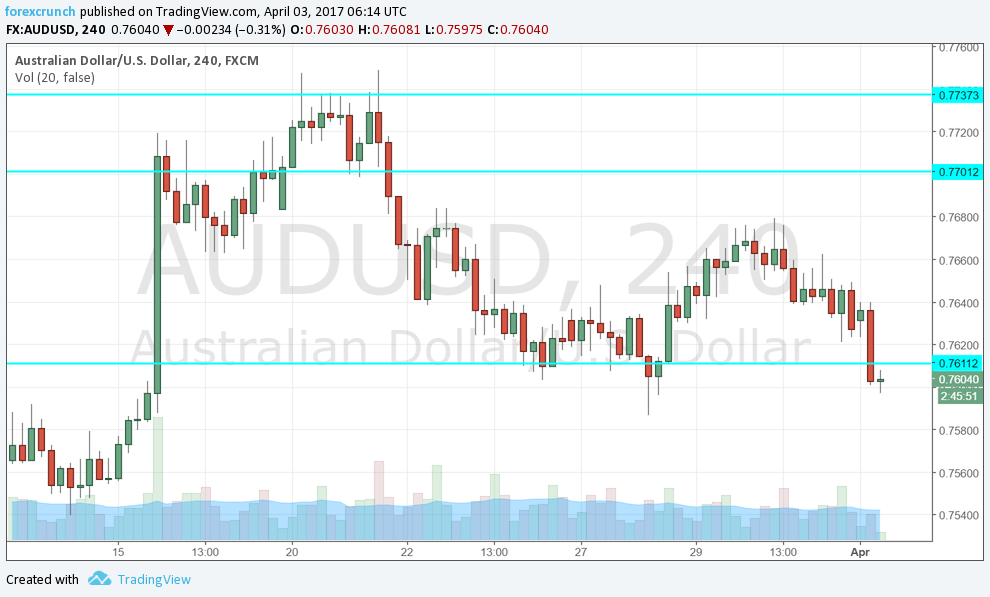

The Australian dollar begins the second quarter of 2017 with a downfall. AUD/USD is struggling to hold onto the 0.76 level, just under support at 0.7610. The pair has been trading in the 0.7610 to 0.77 level for quite some time.

The main driver to the downside is retail sales. The volume of sales dropped by 0.1% in February, against expectations for +0.3%. This follows a rise of 0.4% seen in January. Year over year, it’s up 2.7%, but the number is the lowest since 2013.

Other Australian data points were not that bad: the AIG manufacturing index stands at 57.5 points, reflecting robust growth in the sector. The Melbourne Institute’s inflation gauge is up 0.1%.

Yet perhaps the pressure from data began already in the weekend. China’s Caixin Manufacturing PMI fell below expectations of 51.8 to 51.2. While the data shows Chinese manufacturing continues growing above the pace seen in most of last year, this is a setback from the advances seen in recent months.

Australia is still dependent on its No. 1 trading partner. Despite transitioning away from mining, exports to the Chinese giant remain critical.

RBA coming up next

The Reserve Bank of Australia convenes tomorrow to make the monthly rate decision. There is a consensus that the team led by Phillip Lowe will leave the rates unchanged. The reaction for the Aussie depends on the tone: will they bash the strength of theAA$? Or show satisfaction from the progress of the economy? The poor retail sales report is not encouraging.

More: AUD: 4 Reasons For A Near-Term Correction – CIBC