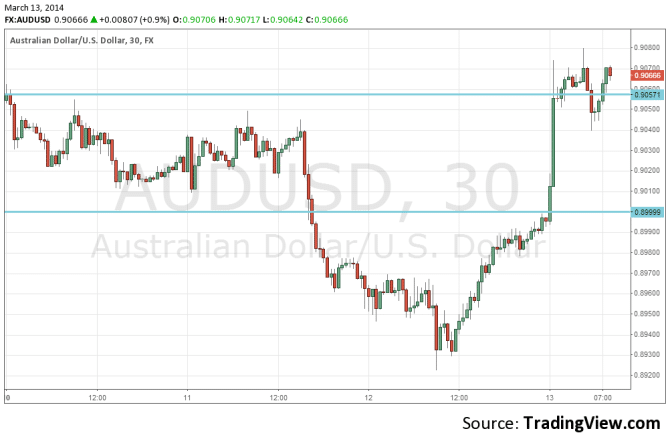

The 0.90 line remains a clear separator of ranges for AUD/USD. The shifts between range trading below the line and above it are sharp and clear.

This time, the pair moved higher thanks to an excellent jobs report from Australia, while ignoring somewhat disappointing Chinese figures.

Australia gained a whopping 47.3K jobs in February, more than triple the early expectations. In addition, this came on top of a much better report from January: instead of a loss of 3.7K jobs, the figure was now revised to +18K.

These job gains did not help Australia lower the unemployment rate: it remained at 6%, a level it reached last month and disappointed markets. The good news here is that the participation rate is on the rise: from 64.6% to to 64.8%. Also here, the participation rate enjoyed an upwards revision for the month of January.

In the composition of the job gains, there is a clear advantage for full time jobs: more than 80K full time jobs were gained, covering for a loss of around 33K part time jobs.

AUD/USD

The Aussie was already edging towards the 0.90 line towards the publication, and the release sent it all the way above 0.9070, above the previous resistance level of 0.9060.

The pair did struggle to rise even higher due to the not-too-good Chinese data: Chinese industrial output rose by only 8.6%, less than 9.5% expected, fixed asset investment rose by 17.9% instead of 19.5% predicted and retail sales by 11.8% and not 13.5%.

Nevertheless, the “risk on” atmosphere which caught the markets left AUD/USD on high ground. For more, see the AUDUSD forecast.