The Reserve Bank of Australia left the interest rate unchanged at 2.50% for the 13th time, as widely expected. Stevens and co. repeated the stance that the “Australian dollar remains above most estimates of its fundamental value”, but this was basically nothing new.

The Australian dollar was already hit by a USD rally beforehand, and these words didn’t help it move off the ground.

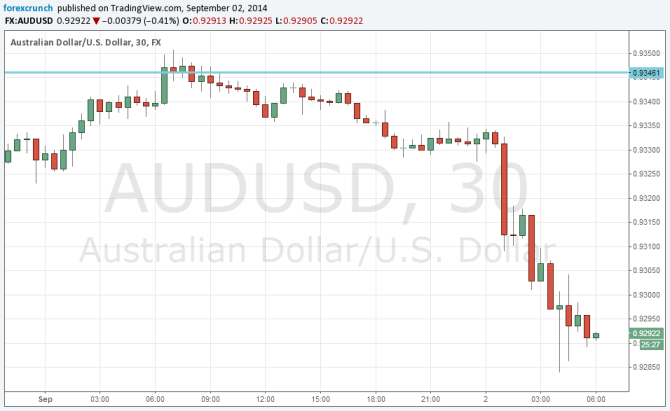

AUD/USD is currently trading just under the round number of 0.93. The pair was around 0.9350 in the previous day. The new low is 0.9284. The pair is currently at the bottom of the recent range.

The RBA statement

The bottom line of the statement remained unchanged: no changes anytime soon:

In the Board’s judgement, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target. On present indications, the most prudent course is likely to be a period of stability in interest rates

Other notes from the RBA: it notes a weakening China property market: this affects Australian iron exports. Mining investment is predicted to fall significantly. However, investment plans outside the mining sector are improving.

Growth is seen as moderate according to recent data and inflation is expected to remain consistent with target. Regarding employment, the central bank sees a degree of slack capacity and some time before the unemployment rate falls.

More data

Also in Australia, building approvals came out at a rise of 2.5%, better than 1.7% expected. In addition, June’s data was revised to the upside.

Australia’s current account for Q2 came out at a deficit of 13.7 billion A$, within expectations, but the previous quarter’s deficit was revised to the downside.

Tomorrow we have the GDP report from Australia.

For more, see the AUDUSD forecast.

Here is how it looks on the chart: