The US dollar did enjoy a comeback of sorts thanks to better than expected inflation data, but commodity currencies recovered quickly, with the Canadian dollar leading the pack and the New Zealand dollar enjoying its own strength.

However, the Australian dollar is somewhat left behind, especially on rising expectations for a rate cut on November 3rd:

Goldman Sachs says that the RBA could be forced to cut rates, perhaps because of the weather pattern known as El Niño. The damage from weather could trigger two cuts already in 2015, sending the rates to a new historic low of 1.5%.

Also UBS expect the RBA to move in November even though it is not a done deal. This may be in response to the move by Westpac to raise their mortgage rates because of new regulation.

The financial stability report from the RBA was quite balanced, pointing to risks in some housing markets but also seeing stability. Yesterday’s jobs report was not too good, with jobs lost in September.

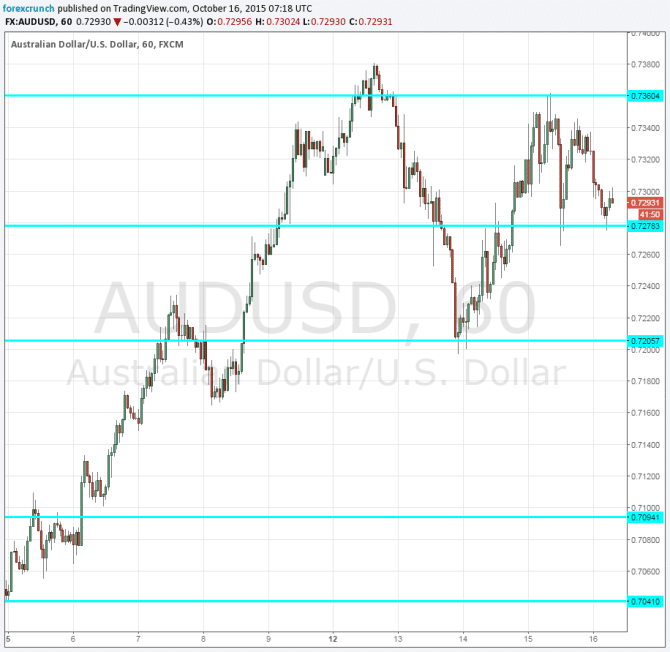

All in all, AUD/USD is still holding above the 0.7280 level, which is a clear separator of ranges, but far from the highs of nearly 0.74 seen earlier in the week. 0.7360 is resistance and 0.72 is lower support.

More: AUD/USD sees downside potential [Video]