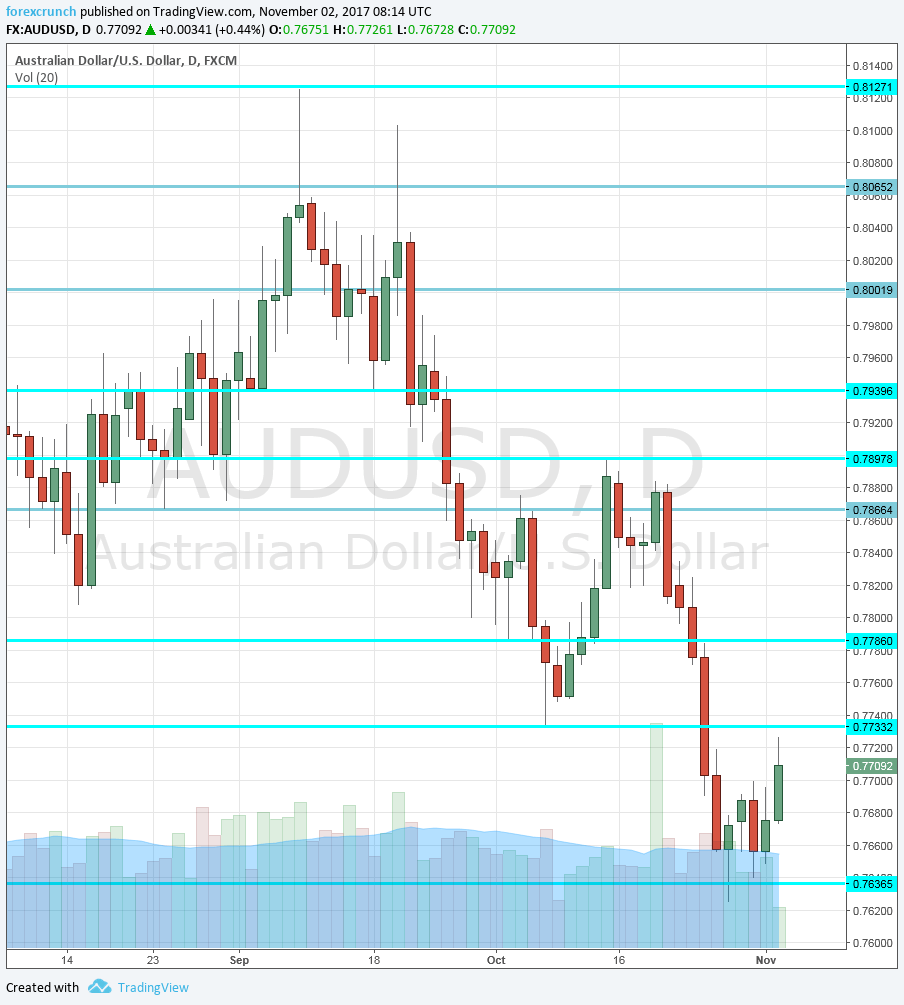

The Australian dollar suffered from a poor inflation read and dropped to the lowest in three months. Yet from this abyss at 0.7620, the pair bounced from the line of support and topped 0.77. The high so far has been 0.7726.

The Australian dollar has been propelled higher by better data. Australia reported a trade surplus of 1.75 billion for September, significantly higher than 1.42 billion expected and much better than 0.87 billion reported beforehand.

Building approvals also beat expectations with a rise of 1.5%. A drop of 0.9% was projected and after a minor rise of 0.1% according to the updated data. Resistance is very close: 0.7730. A further cap is at 0.7780.

Where next for Aussie/USD?

It is good to see the Aussie clearly responding to economic data and providing a straightforward reaction. This makes the pair more predictable.

Can it continue to higher ground? A lot depends on the rate decision next week, and the odds are not that great. The RBA may acknowledge the drop in inflation, which is its mandate and perhaps hint of a rate cut in 2018. In this case, today’s gains may be quite limited.

However, President Trump is likely to announce the nomination of Jay Powell as the head of the Fed, and this weighs on the US dollar. So at least for now, the Aussie could remain more balanced.

More: Elliott Wave Analysis: AUDUSD and NZDUSD

Here is how the AUD/USD looks on the daily chart: