The Australian jobs market gained only 300 jobs in February, significantly worse than 11.6K expected and not covering for a revised loss of 7.4K jobs in January. The unemployment rate surprisingly dropped from 6% to 5.8%, but that came on the back of a drop in the participation rate from 65.2% to 64.9%.

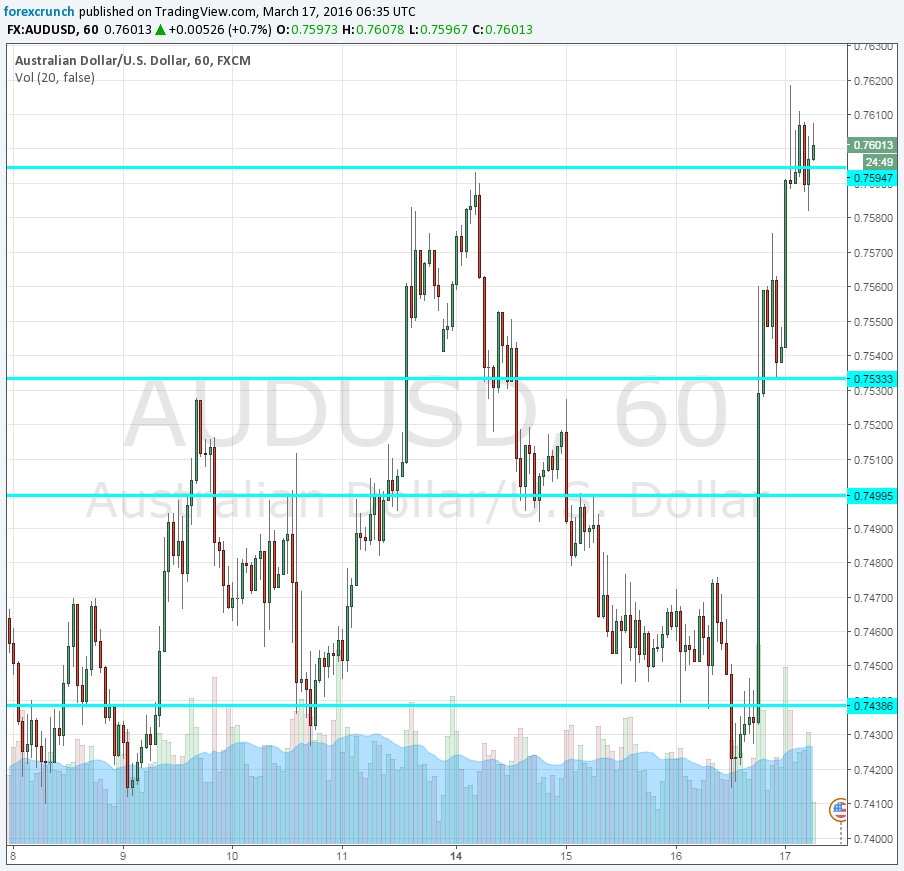

AUD/USD did react with some choppy trading, but the weakness of the US dollar following the dovish Fed decision meant that the pair remains around 0.76, on high ground.

The internal data of this Australian report is somewhat better: a gain of 15.9K jobs while 15.6K part time positions were lost.

Earlier in the day, the, RBA member Debelle said that they would like a weaker Australian dollar, but that also other central banks would want that, taking the sting out of the statement.

The Federal Reserve not only lowered the rate hike path but also its expectations for inflation and growth. In addition, the level of worry regarding global growth was surprisingly stark.

Here is how it looks on the chart. The pair clings to 0.76. The high so far has been 0.7618 and 0.7530 works as support.