The Reserve Bank of Australia did not change its interest rate. This was no surprise. However, as with the July decision, they also refrained from making any changes to their forecast.

And when the team discussed the Australian dollar, they stressed that if the Australian dollar continues to appreciate, it will hurt economic activity. One source of uncertainty has been the outlook for domestic consumption, which looks uncertain. Housing debt has out passed the slow growth in incomes.

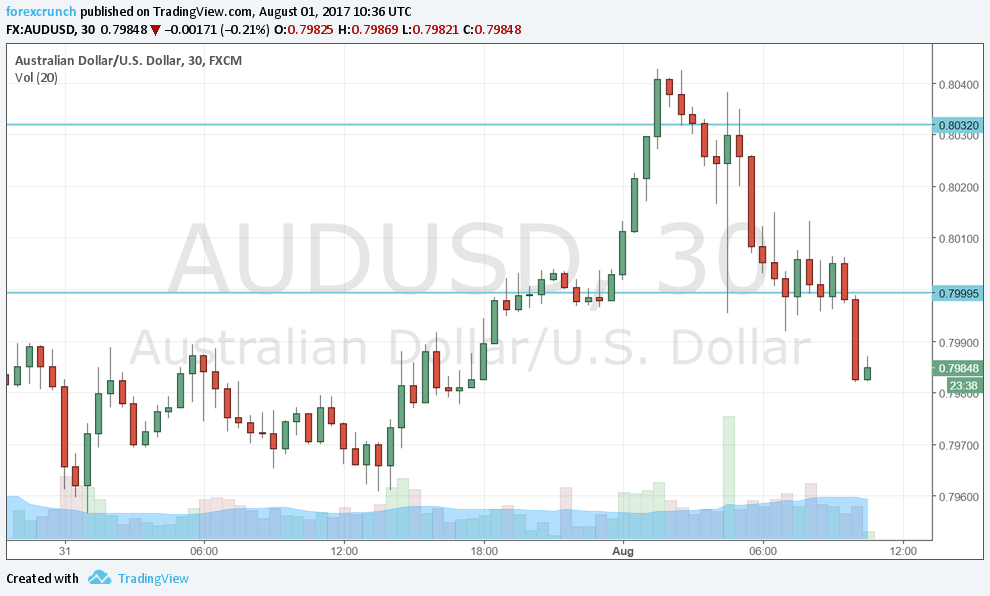

This weighs on AUD/USD. Alongside a small correction in favour of the US dollar, AUD/USD is slipping under 0.80, a line it had struggled to conquer.

If we look back to that July decision, it was followed by a very different message from the meeting minutes. The RBA discussed eventually raising rates to a level of 3.5%, 2% above the current 1.5%. Will the meeting minutes provide hawkishness once again? Is this fall just a temporary correction on the way up?

More: AUD/USD: A Correction Lower Is Overdue; Above 0.80 To Be Met With RBA Opposition – BTMU

Aussie/USD trades at 0.7980 at the time of writing. It had already reached 0.8065, so this is a significant downfall. Support awaits at 0.79, followed by 0.7835, which was the previous cycle high.

Resistance is at the recent high of 0.8065, followed by 0.8150 and 0.83.

Here is how it looks on the chart: