The Australian dollar has been on a roll but seems to lose some ground. It is now approaching an interesting technical level. Also dollar/yen has its technical characteristics.

Here is the view from JP Morgan:

Here is their view, courtesy of eFXnews:

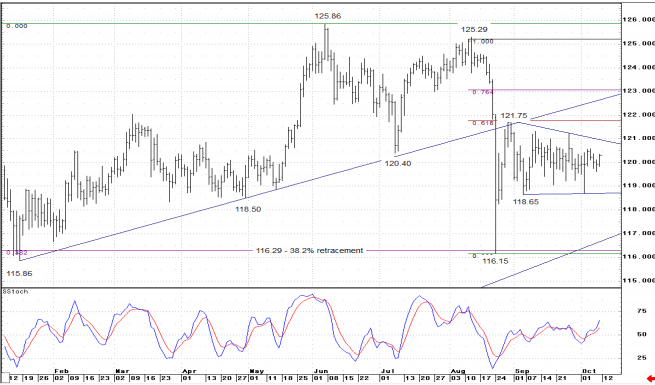

The overall range bias continues in USD/JPY, notes JP Morgan.

“Again, the key levels remain well-defined especially given last week’s effective test and reversal from the 118.65 support area. Again, this area should continue to hold to maintain the potential for a deeper short term recovery.

The upside focus stays on the 121.00/80 area with breaks necessary to allow for an extension into the 123/124 zone (Cwave).

Alternately, a failure to hold the 118.65 support would allow for a closer test of the medium term range lows in the 116.00/50 zone,” JPM projects.

Turning to AUD/USD, JPM notes that the short term advance continues to develop with an impulsive bias while raising the risk that a deeper retracement is underway.

“The focus is now on the critical .7380/.7440 zone which includes the August peak and the 38.2% retracement from the May high. Upside breaks would target the .7600 area.

A break below the .7135/00 area would be the first sign that this corrective phase is starting to falter and potential bearishly shift,” JPM adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.