The Australian dollar weakened on soft CPI and also on Chinese worries, reaching the 0.70 handle. Some see it settling there, but it may go further down.

There is more room to the downside, says the team at Credit Agricole:

Here is their view, courtesy of eFXnews:

The AUD has been under pressure for most of the week, mainly on the back of weakening price developments and ongoing uncertainty related to conditions in China.

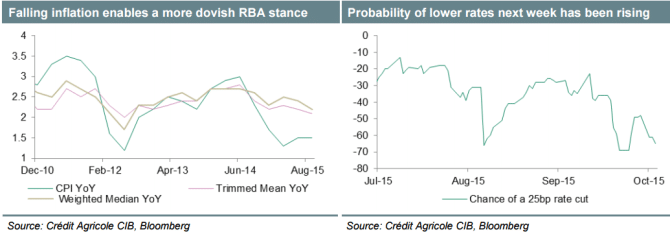

Weak Q3 inflation data came in well below expectations and this should keep the risk of the RBA easing monetary policy further intact. Even if the central bank refrains from lowering rates as soon as next week it is likely to keep all its options open.

Elsewhere, we expect the AUD to remain driven by external factors such as global risk sentiment. As we see limited room for further rising liquidity expectations, accelerating global growth momentum may be required to maintain investors’ demand for risk assets. This is especially true as the Fed appears to be moving closer to a lift-off later this year and as Asia-related uncertainty is continuing.

As a result we remain of the view that the AUD faces further downside risks towards 0.68 and below until the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.