The euro found reasons to slide this week and the Aussie has no real reasons to cheer.

What do the technical charts say? The team at SocGen analyzes AUD/USD and EUR/USD:

Here is their view, courtesy of eFXnews:

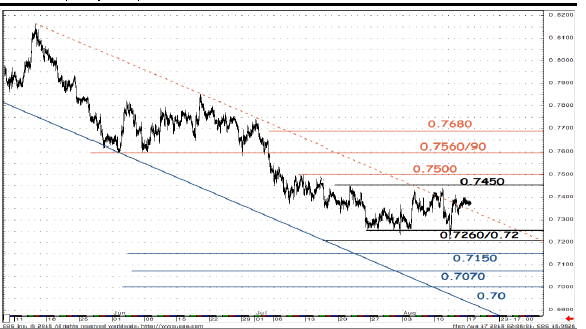

AUD/USD has formed a weekly hammer near 0.72 which represents 76.4% retracement of 2008-2011 up move, notes SocGen.

“It is at the upper limit of a descending channel since May and is facing immediate resistance at 0.7450. With daily RSI breaching above a resistance trend, a recovery is likely,” SocGen adds.

“A break above 0.7450 will mean a retest of recent lows at 0.7560/90 which remains pivotal for an extended rebound,” SocGen argues.

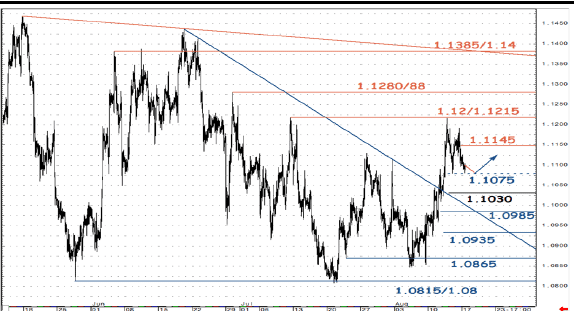

Turning to EUR/USD, SocGen notes that it has retraced after testing 34 week MA at 1.12.

“EUR/USD is forming a triangle after retracing from 1.1450/1.1536. Weekly RSI is below 50% graphical level which highlights persistence within triangle,” SocGen adds.

“Triangle upper limit at 1.1385/1.14 should provide strong resistance to a recovery while 1.0865/1.08 decides if retest of 1.05/1.04 happens,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.