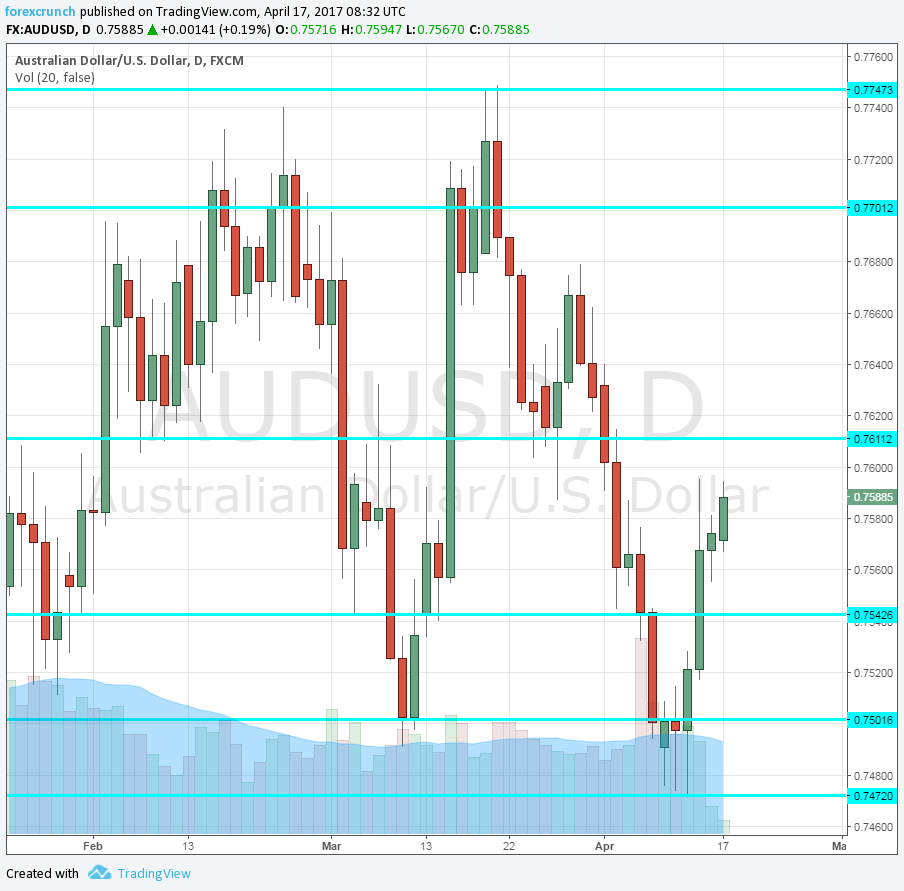

The Australian dollar extends its gains and edges closer to the previous, higher range. AUD/USD is trading at 0.7589. It seems clearer that the stubborn support at 0.7472 marked a bottom for the pair.

The backdrop for the Aussie’s ascent comes from its No. 1 trading partner. China released a bulk of economic data and they were all good. First and foremost, the economy grew at annualized pace of 6.9%. This is a beat on 6.8% expected and marks an uptrend after the last quarters of 2016 saw GDP rising at a pace of 6.7%.

Other data were also upbeat. Industrial output increased by 7.6%, handily above 6.2% predicted. China’s industry creates demand for Australia’s raw materials. Fixed Asset Investment jumped by 9.2%, also above predictions.

And for those looking for a transition from industry and investment towards services and consumption, the retail sales number provided good news. Consumption rose by 10.9%, above 9.7% expected.

More: AUD/USD leaps on great jobs report, two other factors

AUD/USD also pushed by the falling dollar

Aussie/USD also enjoys the downfall in the dollar. While geopolitical tensions (North Korea, Turkey) can explain the slide of the greenback against the safe-haven yen), the US dollar is also on the back foot against other currencies.

And the Aussie is there to benefit. Further resistance awaits at 0.7610, followed by 0.77 and 0.7775. Support is at 0.7540 and 0.75.