Australia’s preliminary estimate for June nominal Retail Sales was pointed to a 2.4% increase in the month.

Retail Sales

AUSTRALIA JUNE RETAIL SALES +2.7 PCT M/M S/ADJ (REUTERS POLL +2.4 PCT)

AUSTRALIA Q2 CHAIN VOLUME RETAIL SALES -3.4 PCT Q/Q S/ADJ (REUTERS POLL -3.2 PCT)

AUD/USD update

AUD/USD was down 0.13% ahead of the data today in a fade on rallies.

The currency has been under pressure in a barroom brawl at the start of the week as the greenback corrects across the board.

A weight on the currency falls with the surge in virus cases in Victoria.

In fact, the Australian new coronavirus cases for Victoria are said to have 439 cases added just today.

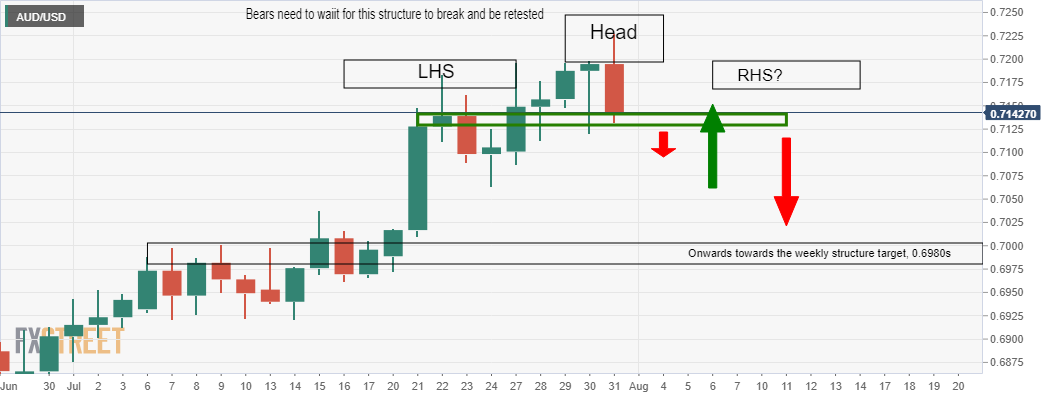

- The Chart of the Week: AUD/USD toppy, H&S could be in the making

The chart above was attached in this week’s Chart of the Week yesterday to illustrate the prospects for a barroom brawl and construction of a bearish head and shoulder’s right-hand shoulder.

This was playing out throughout Europe and New York markets overnight and has continued to do so throughout Asia, so far, today as traders get set for the RBA.

Meanwhile, looking ahead, no change in the stance of policy is expected at the August RBA meeting.

A full discussion of the outlook and risks will follow on Friday as the RBA releases its latest Statement on Monetary Policy. Recent RBA commentary has indicated scepticism over policy options such as negative interest rates and FX intervention. But Australia’s deteriorating economic outlook means the topic needs to be addressed,

analysts at Westpac explained.

Description of the Retail Sales

The Retail Sales released by the Australian Bureau of Statistics is a survey of goods sold by retailers is based on a sampling of retail stores of different types and sizes and it”s considered as an indicator of the pace of the Australian economy. It shows the performance of the retail sector over the short and mid-term. Positive economic growth anticipates bullish trends for the AUD, while a low reading is seen as negative or bearish.