The Australian dollar prefers looking at the balanced RBA statement than the fresh data from both Australia and more importantly from China, and remains upbeat.

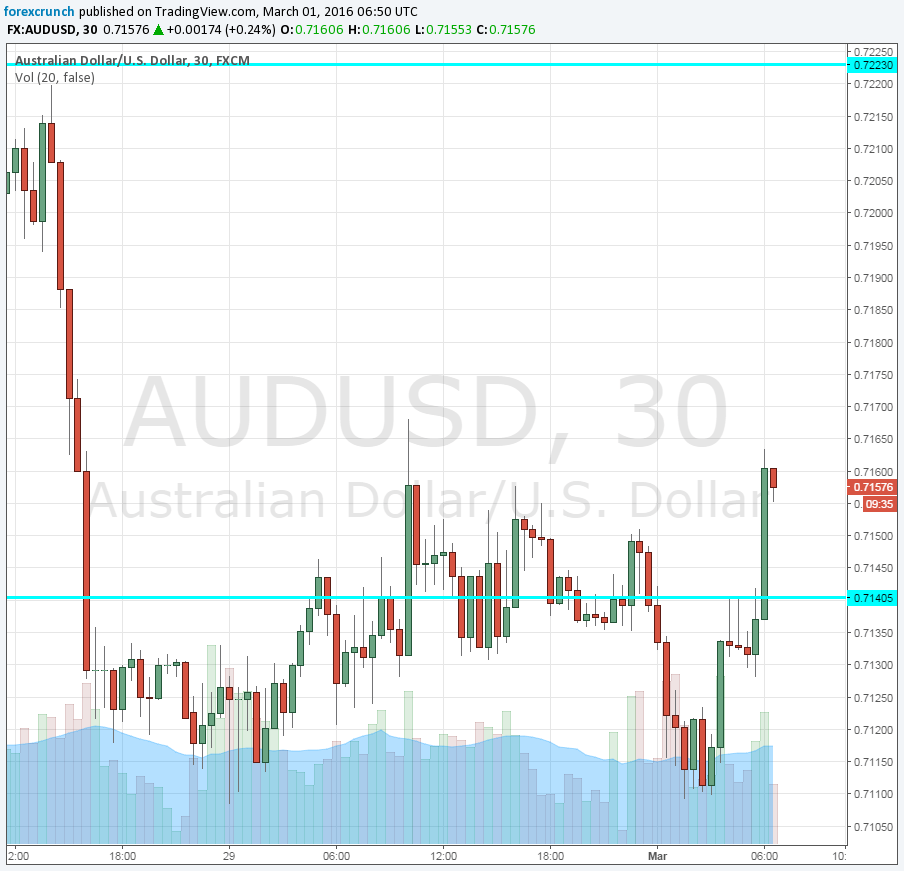

AUD/USD remains at 0.7160, above support at 0.7140.

Calm RBA

The Reserve Bank of Australia left the interest rate unchanged and also did not sound worried about the exchange rate. They said that “AUD has continued its adjustment to changing economic outlook”, which is quite benign.

The only mildly dovish wording says that the global economy is slowing at a “slightly” lower pace. They do not seem worried. This is different from the market mood.

This confidence from Glenn Stevens and co. trumps the worrying data we had beforehand

Worrying Chinese Data

- Australian building approvals fell 7.5%, nearly triple the early expectations for -2.9%

- Australia’s current account came out at a negative 21.1 billion against 19.8 billion expected. That’s quite a sizable deficit.

- China’s official manufacturing PMI dropped from 49.4 to 49 points in February, reflecting a deeper contraction.

- The Chinese Caixin manufacturing PMI also fell 0.4 points from 48.4 to 48 points, and this doesn’t look good.

- Also China’s non-manufacturing PMIs were sliding, coming out worse than expected.

China is Australia’s main trading partner, and any slowdown there should be worrying. However, the A$ is in a “no worries” mood.

One of the factors that keeps the Aussie bid is the relative calm and even upbeat sentiment is the fact that stock markets in Asia are moving up, and the Aussie is also in the risk camp.

The Aussie dollar faces another big test: the release of Q4 GDP. See how to trade the Australian GDP with AUD/USD.

Here is how the recent moves look on the chart: