Australia releases its inflation figures only once per quarter, making every publication a big market-mover. Volatility did not disappoint this time either. The headline q/q figures came out at with a minor miss of 0.5% instead of 0.5% expected. Year over year, the miss was similar: 2.1% against 2.2% projected.

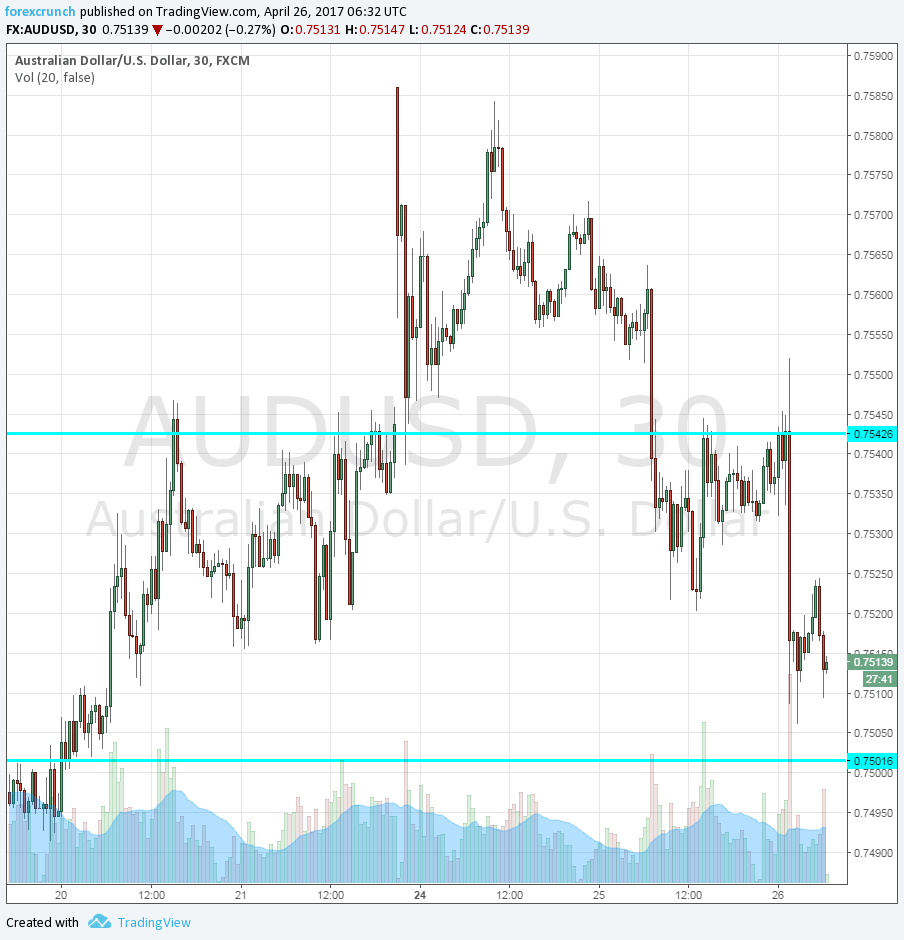

AUD/USD still responded with a downfall, dipping towards the very round level of 0.75 that had worked as a cushion also in the past.

Further support awaits at 0.7450 and 0.7375. Resistance is at 0.7540 and 0.7610.

More Australian inflation measures

Looking deeper into the data, Australia’s core CPI, called “trimmed mean”, has risen by 0.5% as forecast. This was accompanied by small upwards revision. Year over year, core inflation is up 1.9% instead of 1.8% estimated.

Another measure of core inflation, the “weighted mean”, was a miss. It advanced 0.4% against 0.5% expected and 1.7% y/y.

RBA likely to stay on hold for longer

The figures do not imply any kind of rate hike in the near future. They are are also far from being devastating to suggest a rate hike.

On this background, the Aussie is likely to continue moving on the ebb and flow of markets. Currently, the US dollar is on the back foot against major pairs but gaining ground against commodity currencies.

More: AUD/USD trading at the lowest since January – is it about to plunge?