The Australian economy grew by only 0.3% in the third quarter of 2014. This is significantly worse than 0.7% expected and shows that Australia is having a difficult transition from mining to other types of growth. Weak commodity prices certainly weigh on the economy,. Will the RBA cut the rates?

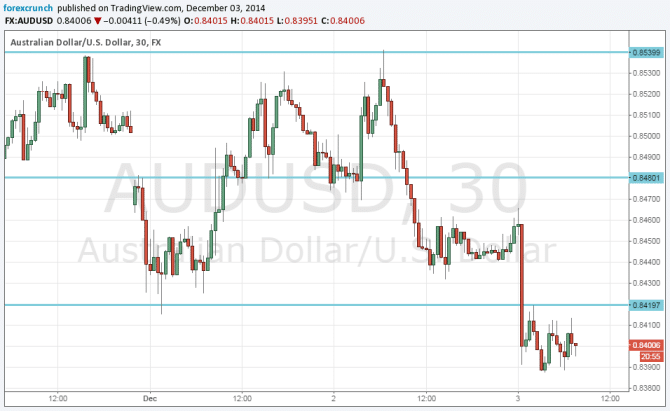

AUD/USD reacted sharply with a clear break down below the previous support line of 0.8420 and down to a new low of 0.8388 before stabilizing.

Here is how it looks on the chart. More details below:

The really strong support line is 0.8066. Until this level, we have a support at 0.8350 and 0.82. For more levels, see the AUDUSD prediction.

Year over year, the economy grew by 2.7%, weaker than 3.1% expected which was also the figure in Q2. Real domestic income declined for a second consecutive quarter. Australia still enjoys net exports, that contributed 0.8% to the GDP growth. The government contributed 0.1% and household consumption 0.3%. However, a negative contribution of 0.7% in gross fixed capital formation. Inventories also subtracted 0.1%.

Data from China: the HSBC services PMI came out at 53 points for November, marginally above 52.9 seen beforehand. The government number is 53.9 points.

Terms of trade decreased by 3.5% (seasonably adjusted). Does this suggest an even lower AUD is needed?

The RBA has left rates unchanged at 2.50% for 16 months. Up to now, some analysts saw a rate cut coming from Australia in 2015, and now a rate cut is also on the cards. In the recent rate decision, the central bank mentioned a “need” for a lower Australian dollar.