An all night session of the Eurogroup with the IMF resulted in scheduling another session for Monday, November 26th, as the sides weren’t able to agree on means to lower Greece’s debt, as well as the long term goals.

EUR/USD, that had a success already priced in, dropped like a rock.

The IMF continues insisting that without a debt reduction for Greece, its debt remains unsustainable. The IMF could even leave Greece and the troika. At this point, it means that euro-zone governments will have to accept losses on money lent to Greece, and this isn’t Merkel’s game plan. These were meant to be loans, that would even yield a profit, not a loss of German taxpayers.

The ministers of the Eurogroup want to settle for easier terms such a lower interest rate on loans to Greece, and a delay in reaching the goals: 120% debt to GDP in 2022 rather than 2020.

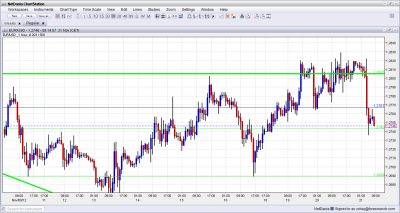

No magic solution was found during the long night. When the meeting ended, EUR/USD plunged from the highs of 1.2821 to 1.2836 before stabilizing on lower ground.

1.2750 serves as weak support, followed by 1.2690. 1.28 is weak resistance, with 1.2880 sitting in the distance.

For more, see the EUR/USD forecast.