Summary:

- BoC holds interest rates steady at 1.0% as widely expected

- Central bank flags uncertainties that include inflation and NAFTA

- Odds for a December rate hike falls below 50% following the BoC decision from 80% previously

- BoC cites exchange rate appreciation could weigh on exports

- BoC forecasts weaker pace of growth. Q4 GDP expected at 2.5%

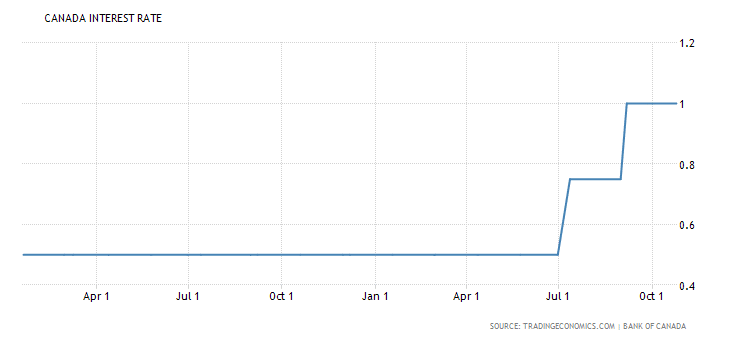

The Bank of Canada held its monetary policy meeting on Wednesday, October 25th. As widely expected, the BoC kept the overnight rate steady at 1.0% and gave a dovish forward guidance. The dovish guidance was given after the central bank hiked interest rates in July and then surprised the markets with a rate hike in September. The BoC hiked interest rates back then by a quarter basis point.

Canada Interest Rates: 1.0%, October 2017 (Source: tradingeconomics.com)

At the BoC meeting, the central bank said that the recent strength of the Canadian dollar was impacting the outlook for exports and also inflation. According to the central bank officials, the contribution of the net exports to the economy’s GDP growth was expected to be slightly weaker.

This comes as the Canadian dollar was seen posting gains against the US dollar. With the US being the largest trade partner for Canada, the exchange rate is deemed to have an impact on the export sector.

The higher exchange rate is expected to remove as much as 0.2 percentage points from the inflation in the second half of this year. However, consumer prices are expected to rise by the second quarter of next year.

The central bank gave its updated forecasts as well. It said that due to the strong performance in the first half, the central bank cut the growth forecasts from 3.1% previously to 2.8%. The third quarter GDP is also forecast to slow to 1.8% on an annualized basis. This comes as the GDP data for July stayed flat and the numbers for August indicated a weakness in the export sector alongside a decline in volumes.

In the second quarter, the Canadian economy surged 4.5%. The central bank also expects the fourth quarter GDP to pick up slightly from the projected 1.8% in Q3 to 2.5% in Q4. Forecasts for 2018 show that the central bank expects growth to expand at a pace of 2.1%.

The NAFTA deal was also mentioned by the central bank as it said in its statement that despite the Canadian economy was operating close to its full potential, there was considerable slack. This was heightened by the recent uncertainty in inflation as well as the possibility of the NAFTA trade deal that could significantly impact Canadian exports.

“While less monetary policy stimulus will likely be required over time, Governing Council will be cautious in making future adjustments to the policy rate,” the bank said in a statement.

The cautious tone of the BoC which comes after the July and September rate hikes lowered the odds for the December rate hike. Previously, economists expected that the BoC will hold off from hiking rates this month but would signal a potential rate hike in December.

After the dovish guidance, the odds for a December rate hike slipped to nearly 34% indicating that the BoC could remain on the sidelines. The Federal Reserve is also expected to hike rates in December which could see the U.S. dollar appreciate further against the Canadian dollar.

The central bank said that the protectionist views on trade from the US could drive businesses to boost production offshore that could impact both business investment and exports.

The central bank also mentioned about the recent tightening of rules in the mortgage sector. This was expected to slow down the activity in the housing markets and the central bank warned of a decline in housing prices in regions such as Toronto and Vancouver.