- The BTC/USD extended its gains and reached the highest levels since early September.

- A general interest in cryptos is behind the move while the SEC delayed another ETF decision.

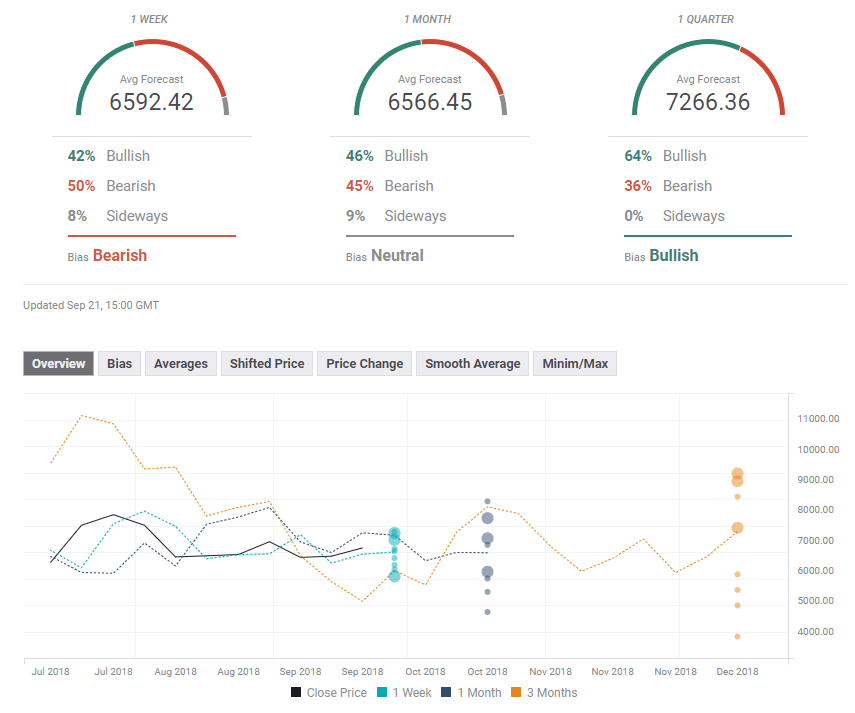

- The technical picture is becoming bullish for Bitcoin. The expert poll shows a bearish bias now, and a bullish one long-term.

The price of Bitcoin went up and neared $6,800 in a positive week for the granddaddy of cryptocurrencies. Altcoins had an even better week, with Ripple rallying quite hard. The moves may be described as a “risk-on” sentiment, whereas investors are more interested in riskier assets than in safer ones.

During the week, the BTC/USD suffered a flash crash to $6,100, blamed on a hack to a Japanese crypto-exchange. The news became public long days after the event and raised suspicion.

The SEC delayed yet another ETF request that was due by September 21st. That did not stop blockchain-based coins to rally. Nevertheless, they could get another boost if mainstream funds enter the crypto-sphere via the mainstream instrument.

To understand more about ETF’s see: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

The upcoming week will likely see more excitement. As Ripple may consolidate its gains and even suffer a sharp correction, Bitcoin could extend its gradual increases. Any news on technological developments will likely support the BTC/USD while regulatory setbacks or hacks may bring it down.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

What’s next for Bitcoin?

BTC/USD Technical Analysis – Getting better with prices rises

The BTC/USD surpassed the 50-day Simple Moving Average which currently stands at around $6,600, a perfect confluence with a former resistance level. It capped the digital coin earlier in the month. The Relative Strength Index (RSI) turned positive and only Momentum is slightly negative.

The next line to watch is $6,800 which was a swing low back in August. Further above, $850 provides another cap after working as a peak in August as well. The $7,150-$2,000 range is next up after supporting the pair when it traded on higher ground. The early September peak of $7,400 is next.

Below the first cushion at $6,600, the next level of support is only $6,200 which was a stubborn floor back in August. It is closely followed by the swing low of $6,100 seen earlier in the week and then by the round number of $6,000 which held the pair in early August. $5,800 is next.

The Forecast Poll of experts shows a bearish bias in the short term, a neutral one later on, and a bullish one in the long term. Forecasts for the short and medium term have remained stable while long-term forecasts enjoyed an upgrade.