Bitcoin prices have stabilized as tension rises towards the updated SEC deadline to approve or disapprove the request from Direxion for a Bitcoin Exchange Traded Fund (ETF). This could be a make or break moment for the granddaddy of digital coins. The deadline is on September 21st and the announcement could come at any moment. See the three scenarios for the event. What levels should we watch?

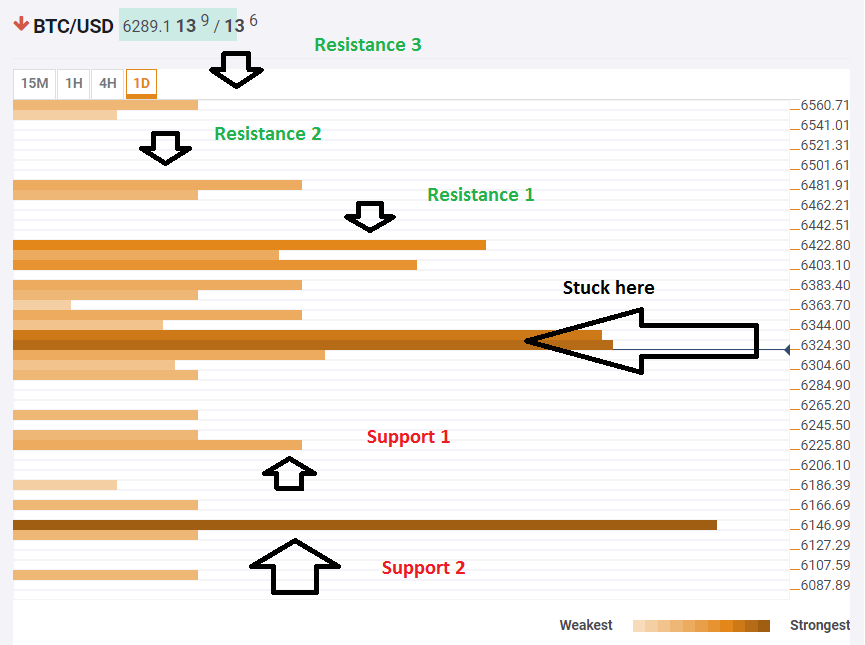

The Technical Confluence Indicator shows that the BTC/USD is currently trapped around $6,324 which is a dense cluster that consists of the Simple Moving Average 50-one-hour, the SMA 10-15m, the SMA 5-15n, the Fibonacci 38.2%, the SMA 100-15m, the Bolinger Band 15m-Middle, the Fibonacci 23.6% one-month, the SMA 50-15m, and more.

Looking up, the first target is $6,422 where the Fibonacci 38.2% one-week, the SMA 5-one-day, the SMA 100-1h, the SMA 50-4h, the SMA 200-one-hour, and the Pivot Point one-day converge.

The next stop is $6,481 where we see the confluence of the Fibonacci 23.6% one-week and the PP one-day R2. Further above, $6,560 is the meeting point of the PP one-day R3 and the SMA 4h.

Looking down, there is some support at $6,225 where we see the PP one-week S1 and the one-day low converge. Stronger support is at $6,146 which is the meeting point of last week’s low, last month’s low, and the Fibonacci 161.8% one-day.

“‹”‹”‹”‹”‹”‹Click to see the Full Confluence Indicator

Here is how it looks on the tool:

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto , and our FXStreet Crypto Trading Telegram channel

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.