The No. 1 cryptocurrency faces its biggest test today. This test is not related to the newly minted record, just under 20,000 USD. It is related to the option to go short on the coin via futures trading on the world’s most important futures platform: the CME.

The first platform to enable futures on BTC/USD was the CBOE and results were mixed. The options tracked the price but in a somewhat erratic fashion. CME is a larger platform and early indicators show a smoother trade, with the prices of futures following the price of bitcoin in a tighter manner.

Short bitcoin – a downfall or a hedge?

We are still in early hours of the day and the big test awaits when US traders come into play in the American morning. That is when the volume is likely to pick up.

Trading on futures in Chicago allows going short on the crypto-currency, thus betting on the burst of the bubble. How many will go short? This could be an indicator of things to come. If many expect the price of BTC/USD to fall, the prophecy could turn into reality,

However, going short via options trading also means that those that buy bitcoin can hedge their bets. Having an “insurance policy” against falls means that more people could actually buy bitcoin.

In any case, this day could turn out to be very interesting.

More: Interest in bitcoin is exploding alongside prices – 10 examples

BTC/USD levels to watch

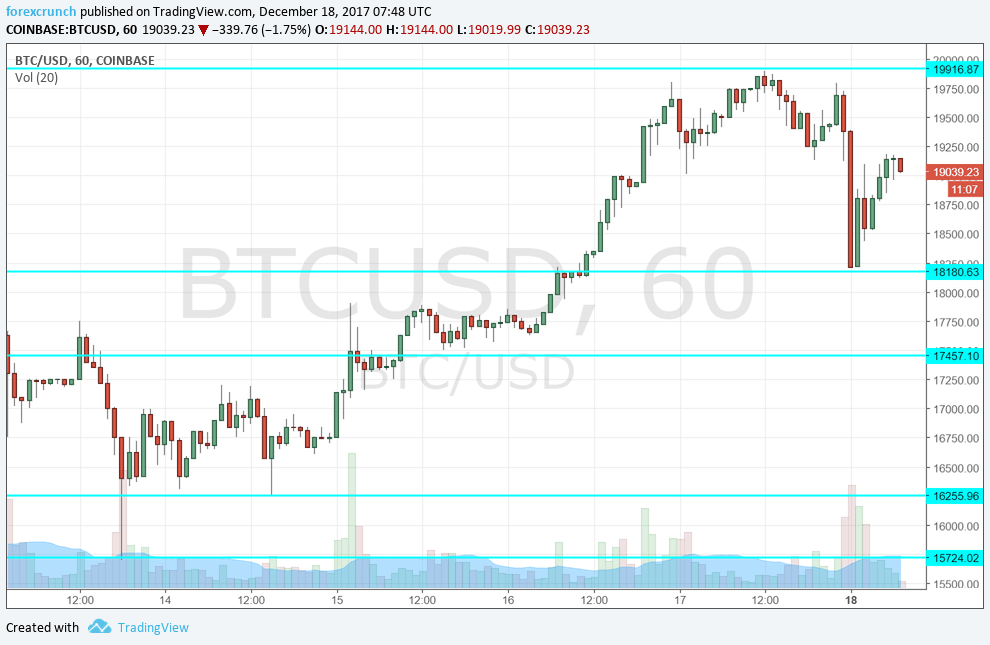

BTC/USD reached a high of $19,916 over the weekend just ahead of the CME Group’s commencement of trading. Since then it dropped and is now just under $19K. Support awaits at $18,180, a swing low that was seen earlier. Looking below, we see $17,450, a level that served as support, followed by $16,255 and $15,725.

More: Finding the real spread in trading bitcoin – TradeProofer covers it