- Cryptocurrencies had a “mini flash crash” that woke them up.

- After stops were cleared and the market bounced, some coins have upside potential.

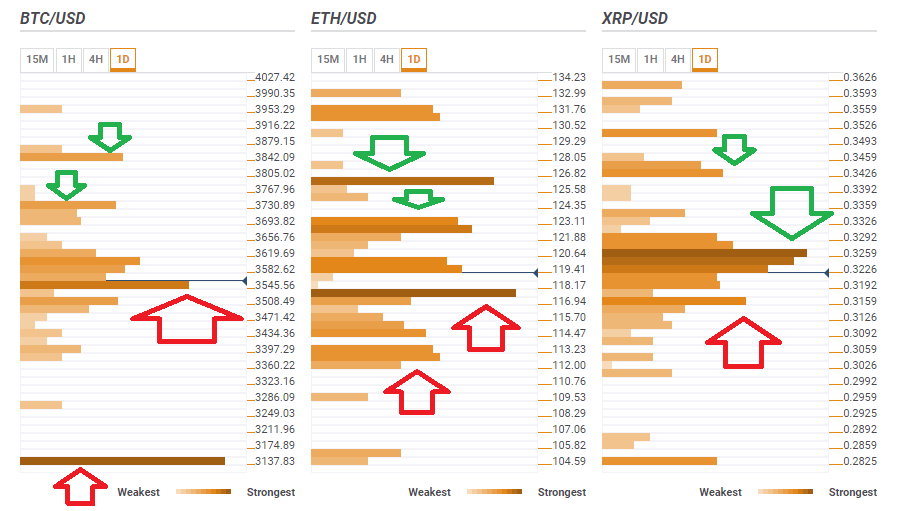

- Here are the levels to watch according to the Confluence Detector.

After a few days of low volatility in crypto markets, a sudden drop was seen earlier, with quick multi-percentage drops. It did not last too long though. It seems that weak hands were shaken off of their assets and buyers jumped in to scoop crypto coins at bargain prices.

This bear revolt, coming amid a cold spell in large parts of the US and Europe, was rejected. But are bulls up to the task of pushing the markets higher?

Some cryptocurrencies have better prospects than others.

BTC/USD recaptured support and looks to the higher ground

Bitcoin,quickly managed to recapture the critical $3,545 level which is a dense cluster including the Simple Moving Average 5-4h, the SMA 200-15m, the SMA 50-1h, the SMA 50-15 minutes, the Fibonacci 23.6% one-week, the Bollinger Band 1h-Middle, the SMA 10-1h, the MSA 10-4h, the Fibonacci 61.8% one-day, and more.

The move above this level represents a clear rejection of the bear attack and provides hope for the bulls.

The next upside target is $3,730 is the convergence of the SMA 50-one-day, the Pivot Point one-week Resistance 1, and the BB one-day Middle.

The next target for BTC/USD is $3,842 where we see the meeting point of the PP one-week R2 and the Fibonacci 61.8% one-month.

If the aforementioned strong support is lost, the granddaddy of cryptos has significant support only at $3,137 where the PP one-month S1 and last week’s low converge.

ETH/USD has support, but also resistance

Ethereum recaptured the $117 level after a scare sent it below that line. The area includes the SMA 10-1h, the SMA 50-15m, the BB 1h-Middle, the SMA 100-15m, the BB 15 minute Middle, the SMA 5-1h, the SMA 10-4h, the SMA 200-15m, the SMA 50-1h, and the Fibonacci 61.8% one-day.

The first upside target is $122 which is where the PP 1d-R2, the SMA 10-1d, the SMA 200-1h, and the SMA 50-4h converge.

Further above, $126 is a tough line where we see the Fibonacci 61.8% one-week and the PP one-day Resistance 3.

Vitalik Buterin’s brainchild suffered from the delay in the Constantinople upgrade and if another delay is seen, the next support level is $112where we see the Fibonacci 61.8% one-month, the BB 4h-Lower, the PP one-month S1, the PP one-day S2 and more.

XRP/USD is stuck

Ripple recovered, but faces fierce resistance at $0.3250 which is a minefield of lines including the previous daily high, the PP one-day R1, the SMA 5-one-day, the Fibonacci 38.2% one-week, the Fibonacci 23.6% one-day, the BB 15min-Upper, the Fibonacci 23.6% one-month, and the SMA 100-1h among others.

It will be hard to break this line, but if it happens, the third-largest digital coin will target $0.3426 where we see the PP one-week R1, the SMA 50-1d, and last week’s high.

Support for XRP/USD is at $0.3159 where we see the confluence of last week’s low, the BB 1h-Lower, the PP one-month Support 1, and the BB 15min-Lower.