Cryptocurrencies and especially Bitcoin are on a bull run. BitMex, a major crypto-exchange, went quiet for an hour, allowing the Bitcoin bulls to take over the show. In addition, Thursday’s SEC deadline on the ProShares ETF is highly anticipated.

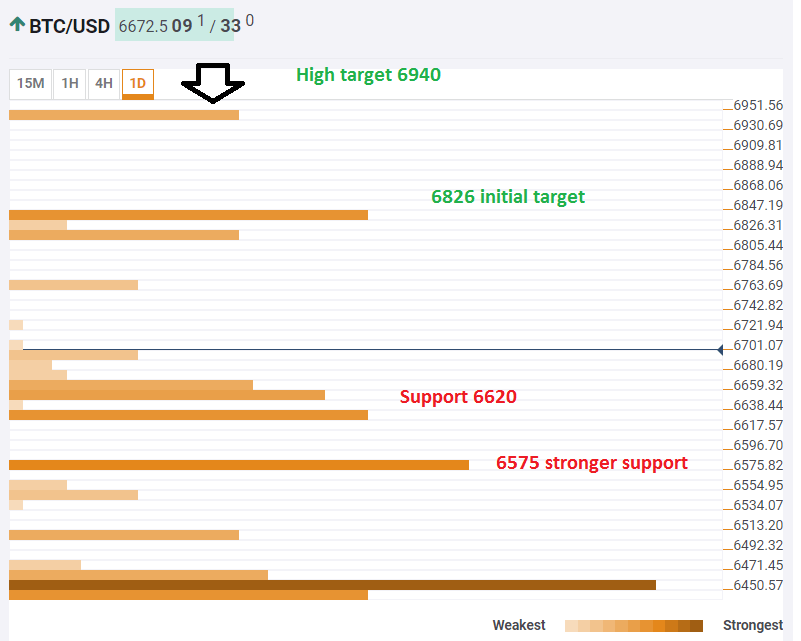

The Technical Confluence Indicator shows that the BTC/USD has an initial target of $6,826 which is the convergence of the Bolinger Band one-hour Upper, the Pivot Point one-week Resistance 1, and the Pivot Point one-day Resistance 3.

The higher target is $6,940 which is the 50-day Simple Moving Average, a significant level watched by many..A potential break above this level would be another bullish sign.

On the downside, Bitcoin has support at around $6,620 where we see the 4h low, the BB 4h-Upper, the SMA 50, and last week’s high.

Stronger support is at $6,575 which is the meeting point of the Pivot Point one-day Resistance 1 and the BB one-day Middle.

All in all, the price of bitcoin is well positioned to take advantage of the current upswing. A lot depends on the SEC decision on ProShares’s request for a Bitcoin ETF.

Click to see the Full Confluence Indicator

Here is how it looks on the tool:

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto , and our FXStreet Crypto Trading Telegram channel

This tool assigns a certain amount of “weight” to each indicator, and this “weight” can influence adjacents price levels. These weightings mean that one price level without any indicator or moving average but under the influence of two “strongly weighted” levels accumulate more resistance than their neighbors. In these cases, the tool signals resistance in apparently empty areas.