It has been a bullish week for Bitcoin price even as it traded above the $40,000 psychological level for the first time this month. This has bolstered bulls who made sure that BTC closed five consecutive days in the greed between July 26 and July 30. The flagship cryptocurrency closed the day on Saturday in the red indicating that the bears are determined to make sure the price does not remain above the $42,000 mark.

Let’s have a look at the week that was.

Bitcoin Price, The Week That Was

BTC/USD price rose by 20% in the week ending July 31. Significantly surpassing a 11% gain from then previous week, Bitcoin closed the week at around $41,230.

Bitcoin price started the week trading in then green after making a rising by about 22% from the July 20 low at around $29,150. On Monday Bitcoin broke above the $40,000 psychological mark for the first since June 14 before sliding down to an intraweek low at around $36,400 on Tuesday bust still remained bullish.

The buyers were determined to stretch the bullish leg which saw the Bitcoin price break above the first major resistance at the $40,000 psychological level. This is the place where it coincides with the 100-dal Simple Moving Average (SMA). A push past this level saw the largest cryptocurrency rally to high of around $42,300 today.

- Read this guide if you interested in learning more about buying cryptocurrencies?

During the week, BTC price broke through the first major resistance level at $37,600 to the week and at $36,400 and flipped the 100-day SMA from resistance to support.

Trading five consecutive days in the green including a 6.47% gain on Wednesday and 5.72% rise on Friday was the week’s upside.

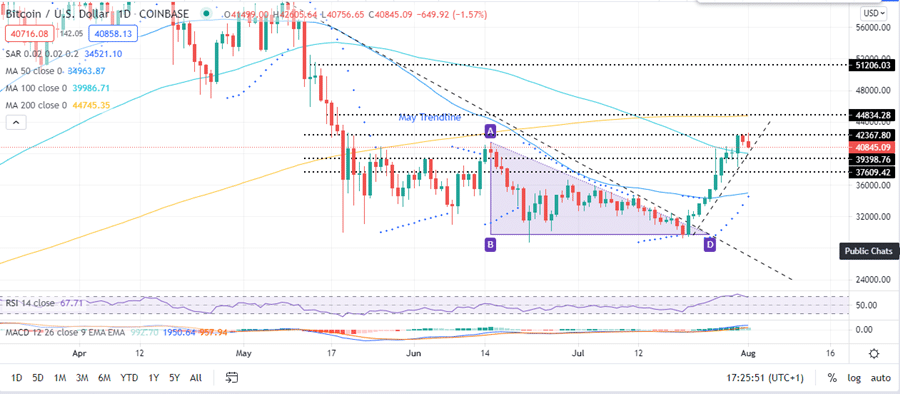

Bitcoin Price (BTC/USD) Daily Chart

BTC Price, The Week Ahead

At the time of writing, Bitcoin price is hovering around $40,845 and appears to battle the resistance posed by the apex of a descending triangle at around $41,400. BTC will need to close the week above this level to bring $42,000 levels to the picture.

Robust support from the market would be needed for Bitcoin price to slice through the major resistance which is currently defined by the 200-day SMA at around $44,800. If this happens, Bitcoin could break through the third major resistance level at the $45,000 psychological level to retest the May 13 high around the $50,000 mark.

Note that closing the week $40,000 mark would bring the first major support level at $39,400 into play. A further fall would see BTC re-test the support levels at 37,600 and $35,000 respectively.

The general crypto signals for the week ahead remain bullish as seen by the positive parabolic SAR and the positive of the MACD above the zero line on the daily chart.

Looking to buy or trade Bitcoin now? Invest at eToro!

Capital at risk