Euro dollar changed direction and after it had increased in the past couple of days, it changed direction and was traded down yesterday (March 27th) by 0.32%. Yesterday was a slow day with little movement not only in the forex markets, but also in related financial markets such as commodities and stocks markets. OECD stated yesterday the Euro Zone’s debt crisis isn’t over just yet. Many EU banks are still struggling and remain weak, the sovereign debts are still high and keep stocking up and fiscal targets are far off course. This news may have been responsible for the slight shift in market sentiment. Today there are several news items on the agenda including US core durable goods report and Euro Area M1, M3 Money Supply Development.

Here’s an update on fundamentals and what’s going on in the markets.

EUR/USD Fundamentals

- Tentative: German Preliminary Consumer Price Index

- 09:00 Euro Area M1, M3 Money Supply Development

- 15:00 U.S Core Durable Goods Orders Confidence. See how to trade this event with the Euro/USD

For more events later in the week, see the Euro to dollar forecast

EUR/USD Sentiment

- OECD Claims the EU debt crisis isn’t over: despite the calm in the financial markets during 2012, the OECD stated yesterday the worst isn’t over for the Euro Zone. The banking system is still weak, the debt levels remain high and the fiscal targets aren’t realistic. OECD also thinks the Euro Zone needs a bigger bailout fund. Currently, these warning words didn’t seem to shift by much the market sentiment as the Euro only slightly decreased against the USD.

- Mario Monti Thinks the Economic problem in Spain won’t spread to Europe: the Prime Minster of Italy stated on Wednesday, March 28th in Tokyo that the economic turmoil in Spain won’t be contagious and won’t spread to the rest of Europe. He also blamed the current debt crisis on Germany and France on account of their role in easing the deficit restraints.

- U.S Consumer Confidence Index Declined n March: The U.S. consumer confidence index declined in March compared: The index reached in March 70.2 (1985=100) a slightly decrease from 71.6 in February. American consumers’ short term outlook in U.S. business conditions has also weakened according to the report. This news may have pulled down not only U.S stock markets but also dragged along with the major currencies. This news may have shifted a bit the market sentiment and marginally reduced the risk appetitive.

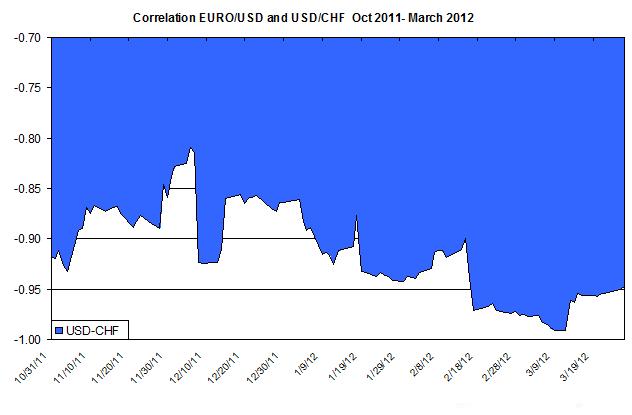

- High correlation between Euro/USD and USD/CHF: Despite the shifts in the forex markets in recent weeks, the linear relation between these two currencies pairs is still strong and robust. Their current linear correlation stands on -0.94 (see chart below). This finding suggests the relation between the Euro and CHF continues to be strong and robust and any movement in the Euro will likely to affect the direction of CHF.